The US government currently holds a significant amount of Bitcoin, with 198,012 BTC valued at approximately $16.94 billion, along with 59,965 Ethereum, worth around $98.43 million, according to market data. Amid this, and several chalked-out crypto plans, can a Bitcoin surge be a repeated phenomenon?

Bitcoin to Turn Bullish With Better Laws?

Hear me out.

Market structure legislation will be a massive boon to the price of Bitcoin.

Once signed into law, the flood gates will be wide open and the rush of capital will be like nothing you’ve ever seen before.

Massively bullish for Bitcoin.

— Dennis Porter (@Dennis_Porter_) April 15, 2025

Dennis Porter, co-founder of the Satoshi Action Fund, believes that upcoming crypto legislation could serve as a powerful catalyst for Bitcoin’s growth. He took to X, suggesting, “Crypto market structure legislation will have a huge bullish effect on Bitcoin’s price. Once this bill is signed into law, the gates of capital will be completely opened, and the scale of incoming funds will be unparalleled. For Bitcoin, this is extremely bullish news.”

Porter’s statement holds further importance considering ongoing discussions within the US government around establishing a Bitcoin Reserve strategy. The White House Director of the National Economic Council, Bo Hines, recently revealed that tariff revenues could be used to buy Bitcoin.

Thus, the possibility of new crypto-friendly legislation, especially under a potential second term for Donald Trump, could set the stage for a bullish crypto market. Trump, a self-confessed crypto advocate, has already conveyed signs of support for the businesses by signing the anti-DeFi broker rule, which is seen by many as a positive move in favor of crypto industry.

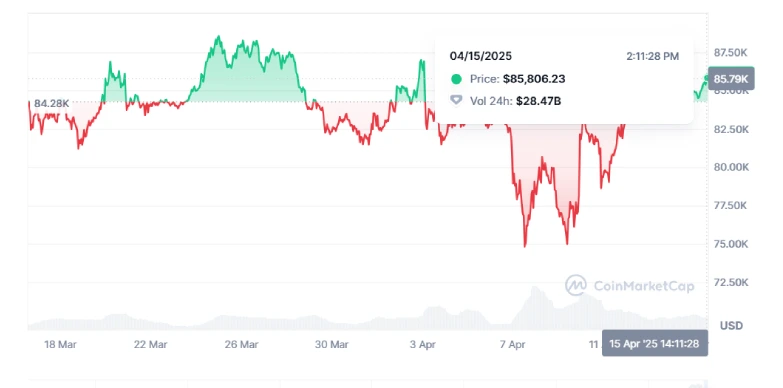

However, even with these promising developments, macroeconomic factors continue to affect Bitcoin’s performance. One major factor is the ongoing US tariff conflict, which recently pushed Bitcoin to a five-month low of $74,436.68.

Nevertheless, markets reacted positively when President Trump announced a 90-day tariff suspension for over 75 countries, along with a reduced reciprocal tariff rate of 10%. Following this announcement, Bitcoin rebounded and is currently trading at $85,806, marking a 1.89% increase in the last 24 hours.

At this juncture, comprehensive crypto legislation does seem to have potential for a bullish Bitcoin market.