UNI, the native cryptocurrency of the Uniswap exchange, shows a slight downtick of 0.74% to trade at $5.23. The selling pressure triggered as the Bitcoin recovery halted at $95,000 resistance, and market sentiment remained uncertain about the U.S.-imposed tariffs. However, the risk of prolonged correction surged for UNI as long-term holders liquidated their positions.

Dormant Whale Movements Add to UNI’s Selling Pressure

Since last week, the Uniswap price has plunged from $6.50 to a current trading value of $3.53, accounting for a 13% fall. The selling pressure was triggered by the slowdown in broader market recovery, and UNI coin witnessed a substantial liquidation from dormant investors.

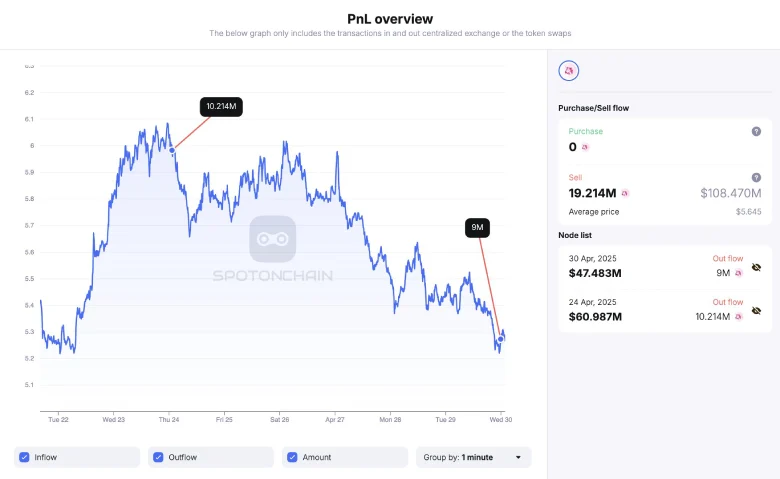

Onchain tracker Spot On Chain reports that a previously dormant wallet linked to Uniswap has suddenly reawakened, transferring a whopping 9 million UNI tokens, valued at $47.5 million, to Coinbase Prime. This wallet had been inactive for over 4.58 years, raising slight speculation about UNI’s possible downturn.

Furthermore, this is not an isolated case, as four wallets connected to the Uniswap project have collectively transferred 19.21 million UNI tokens (worth approximately $108.5M) at an average price of $5.65 per token in the last six days.

The long-term holders exiting their position in an asset have often impacted the market sentiment negatively and raised selling pressure for a prolonged retest downfall.

Also Read: Nasdaq Seeks SEC Nod for 21Shares Dogecoin ETF; Will Price Hit $0.2?

Uniswap Price Faces a 12% Drop Ahead

In the daily chart, the recent falling Uniswap price shows a clear reversal from the downsloping resistance trendline. Over the past two months, the dynamic resistance has acted as a sell-off point for bears, signaling a risk of prolonged downfall.

In addition, the coin price also plunged below the fast-moving 20-day exponential moving average. Since December 2024, the buyers have shown several attempts to breach resistance, but each failure has ensured market selling pressure for a prolonged fall.

If this holds, the Uniswap price could plunge 11.7% to seek support at $1.77.

Also Read: South Korea to Introduce 7 Crypto Policies, Open Spot ETF Trading