UNI, the native cryptocurrency of the decentralized cryptocurrency Uniswap, bounced 15% during Friday’s U.S. trading session to reach $10.25. This buying pressure aligns with the general bullish sentiment in the market as the White House prepares for the passage of the GENIUS Act. Another factor contributing to Uniswap price recovery is an aggressive accumulation from crypto whales, signaling their confidence in the asset’s future growth.

UNI Soars on Regulatory Tailwinds and Major Whale Withdrawals

Over the last two weeks, the Uniswap price has shown a strong recovery, rising from $0.6812 to its current trading price of $10.24, representing a 50% growth. A primary catalyst for this rally is general bullish sentiment in the market as investors’ anticipation grew during the ‘Crypto Week.’

Just yesterday (July 17th), the U.S. House of Representatives passed three crypto bills: the Clarity Act, the Genius Act, and the Anti-CBDC Act, marking a crucial legislative development in regulating digital assets in the United States. While the retail investors may think the news-driven rally has already been priced in, the crypto whales continue to accumulate more UNI.

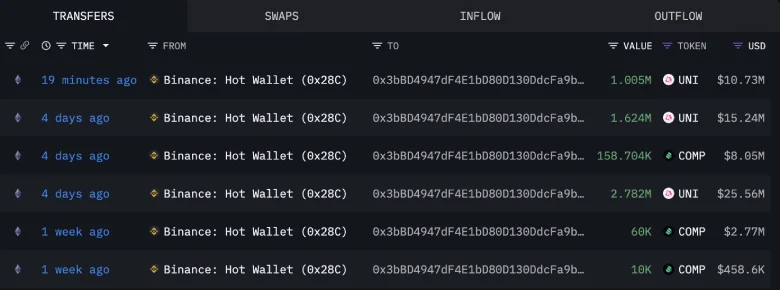

According to blockchain tracker Lookonchain, a newly created wallet withdrew 5.41 million UNI (worth approximately $57.79 million) and 228,704 COMP tokens (worth $12.15 million) from Binance over the past 10 days.

Data from Arkram Intelligence shows the latest transaction occurred 19 minutes before the reporting, signaling continued confidence in UNI’s recovery.

UNI Price To End Multi-Month Accumulation With This Breakout

The daily chart analysis of Uniswap price reveals a recent recovery that has assisted in the formation of a traditional reversal pattern, known as a rounding bottom. Typically, the pattern displays a major accumulation trend with its U-shaped recovery offering buyers a breakout that signals a change in market direction.

With today’s price jump, the coin price teased a bullish breakout from the pattern’s resistance neckline at $10.355. However, the buyers are facing intense overhead supply at this resistance, as evidenced by the long wick rejection in the daily candle.

If the seller continues to defend this level, the UNI price could enter a short correction to the $9.46 or $8.56 floor and recuperate its bullish momentum before the next breakout. From an optimistic approach, a decisive breakout from the neckline with daily candle closing will drive a 56% surge to hit the $16 mark.