- Tuttle Capital, an issuer of innovative exchange-traded funds (ETFs), has filed for three crypto-focused ETFs tied to Bonk, Litecoin, and SUI.

- SUI price rides a short-term pullback within the formation of a bull flag pattern before taking a leap toward $5.

- BONK price is poised for a major breakout from the neckline resistance of an inverted head and shoulders pattern.

- A rising channel pattern drives a mid-term uptrend in Litecoin’s price.

Tuttle Capital Files to Launch ‘Income Blast’ ETFs on Bonk, LTC, SUI

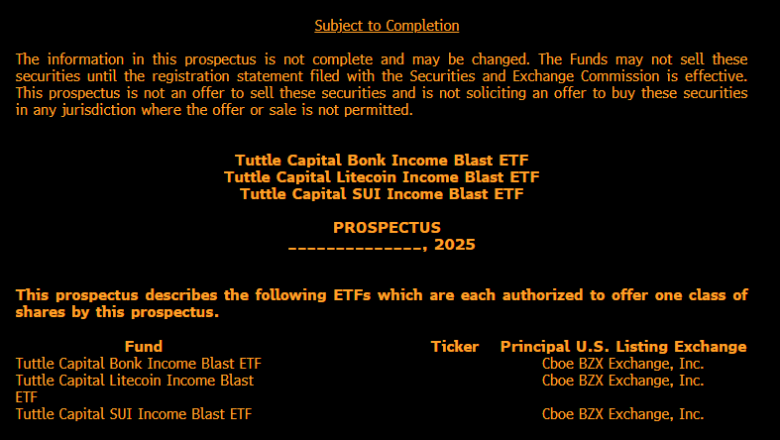

Tuttle Capital Management has filed for a range of new digital asset exchange-traded funds (ETFs) that include a mix of both meme coins and established cryptocurrencies in its structure.

According to the prospectus, the lineup is the Tuttle Capital Bonk Income Blast ETF, the Tuttle Capital Litecoin Income Blast ETF, and the Tuttle Capital SUI Income Blast ETF. All three have been announced to be listed on the Cboe BZX Exchange, subject to regulatory approval.

The documents show that the Bonk Income Blast ETF will get exposure to the Solana-based meme token through direct holdings or exposure through another ETF that would track the asset.

Bloomberg analyst Eric Balchunas points out that this strategy is also set up to generate additional yield by implementing put credit spreads with FLEX options, a structure that provides customization of the strike prices and maturities.

Along with the Bonk product, the filing also identifies the Litecoin Income Blast ETF and the Sui Income Blast ETF, which are patterned on a similar income model.

The prospectus mentions that the information is also subject to change until the registration statement becomes effective with the Securities and Exchange Commission. No tickers are currently assigned to the ETFs.

Let’s dive into the price analysis of each coin.

BONK Price Eyes Key Breakout From Reversal Pattern

The daily chart analysis of the BONK price shows the formation of a traditional reversal pattern called an inverted head and shoulders. The chart setup is characterized by three troughs, i.e, the middle head, followed by two shallow shoulders.

With the intraday jump of 4.18%, the Bone price is currently developing the right shoulder, which theoretically offers a short pullback for the buyers to regain bullish momentum. If the pattern plays as predicted, the coin price should bounce 11.5% to challenge the neckline resistance at $0.00002627.

A potential breakout would accelerate the recovery momentum and set the BONK price to chase the $0.00004 swing high.

Litecoin Price Holds Steady Uptrend Within Channel Pattern

Over the past 4 weeks, the Litecoin price has been wavering around the $115 price level with a series of alternating green and red candles, indicating a lack of initiation from buyers or sellers. Despite the market uncertainty, the coin price holds above the trend-defining exponential moving averages 100 and 200, suggesting that the broader trend in LTC remains bullish.

In addition, the daily chart analysis highlights that the Litecoin price has been riding a steady uptrend since April 2025 within the formation of a rising channel pattern. If the Tuttle Capital Litecoin ETF could bolster demand pressure in this asset, the coin price will restore bullish momentum and challenge the $141 multi-month resistance.

Bull Flag Pattern Sets SUI Price for $5 Rally

In the last three days, the SUI price showed a brief correction from $3.88 to $3.46, a 10% decrease, before reverting back to $3.62. The technical chart shows the reversal occurred at the resistance of a bull-flag pattern, which has been driving the current correction trend since late July.

The chart setup is commonly spotted within an established uptrend, as it allows buyers to recuperate the exhausted bullish momentum before the next breakout. Following the pattern, the coin price should challenge the overhead trendline at $3.77, signaling the continuation of the prevailing recovery.

The post-breakout rally could push the price over 31% to target the $5 psychological level.