TRX, the native cryptocurrency on the TRON network, witnessed a 2.3% drop during Thursday’s U.S. trading session. This bullish momentum defied the broader market sell-off after Bitcoin plunged below the $102,000 level. Moreover, the TRX price continues to maintain its steady rise in active addresses and bullish chart pattern, preparing for an upside breakout.

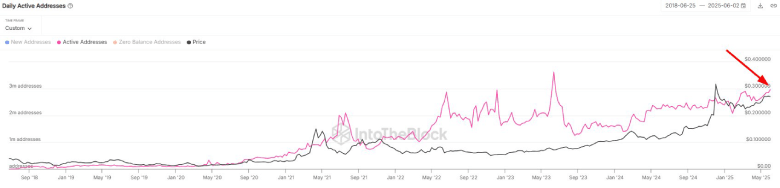

Daily Active Addresses on TRON Approach 3 Million

On Thursday, June 5th, the cryptocurrency market experienced a sudden sell-off after Bitcoin dropped over 3% to break the $102,000 level. According to Coinglass, the market recorded a total liquidation of $964.73 million in the last 24 hours.

Following the momentum, a majority of altcoins, including TRON, initially showed a notable downtick, signaling the continuation of their short-term correction. However, the TRX price bounced immediately as on-chain data from Sentora reveals a significant surge in the daily addresses on the TRON blockchain.

The metric is poised to surpass the 3 million mark, its highest level since May 2023. This sharp increase in activity indicates a growing user base and heightened network engagement, suggesting a possible rebound or renewed interest in the TRON ecosystem.

Thus, rapid growth could bolster buyers to seek a suitable bottom support and align with the long-term uptrend.

TRX Price Loading Next Breakout Amid Pennant Formation

Over the past three weeks, the TRON price has fluctuated within a range of $0.28 and $0.26. In the daily chart, this consolidation displayed rejected pressure on both sides, indicating the lack of conviction from buyers or sellers.

Following today’s intraday surge, the TRX price reached $0.28, indicating the continuation of the lateral trend. However, a deeper analysis of technical chart reversal reveals that the price fluctuations form a bull pennant pattern.

This chart setup is commonly observed in an established uptrend, as it allows buyers to regain strength during the brief break.

If the broader market sentiment doesn’t add too much pressure, the TRX price is likely to test the lower trendline for bullish reversal. A potential breakout from the overhead trendline will signal the continuation of the prevailing uptrend.

The post-breakout rally could push the asset to $0.3, followed by an extended rally to $0.33.

Also Read: DefaiCon Returns: DeFi & AI Lead at Istanbul Blockchain Week