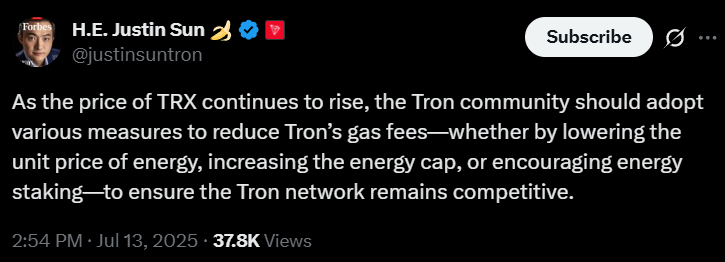

TRON founder Justin Sun has urged the community to implement “various measures” to reduce gas fees amid the cryptocurrency’s surging price.

(Source: Justin Sun on X)

In order to sustain its growth, Justin Sun proposed three key solutions: reducing energy prices, increasing network capacity, and promoting energy staking rewards. He emphasized that these measures will “ensure the Tron network remains competitive.”

His statement comes amid rising TRX prices, which attract greater demand for affordable and scalable transactions on the blockchain. Amid bullish momentum in the crypto market, the cryptocurrency has surged over 10.50% in a month, climbing from $0.27 to $0.30, according to CoinMarketCap.

According to some market experts, TRON (TRX) is showing strong bullish momentum as it approaches a critical resistance level at $0.32, following a confirmed breakout.

Despite a quiet week with just a 2.3% gain, TRX has outperformed major cryptocurrencies like Ethereum, Solana, and even Bitcoin year-to-date, surging over 28% in 2025. This makes it one of the top-performing Layer 1 blockchains this year.

TRX Aims Higher With Key Breakout Zone at $0.32

While TRX lags in short-term weekly gains, its long-term performance stands out. With a 28.4% increase since the start of 2025, TRON has surpassed Ethereum and Bitcoin in growth.

According to data from Messari, TRX is up 22.85% year-to-date, making it one of the most resilient assets in a volatile market. Unlike other cryptocurrencies that faced sharp declines, TRON has maintained stability, attracting investors looking for consistent returns.

TRX is now testing a crucial resistance level near $0.32, which aligns with the 0.618 Fibonacci retracement level. This zone is seen as the last major hurdle before a potential upward continuation. If TRON breaks through, analysts predict a rally toward its 52-week high of $0.46. The weekly chart shows a clear structure with strong pullbacks and recoveries, suggesting that holding above $0.30 could trigger the next bullish wave.

Adding to the bullish momentum, TRX has completed a textbook cup and handle breakout, which is a strong technical indicator. The pattern formed over several months, with a rounded base in early 2025 and a tight consolidation in June. The recent breakout above $0.29 confirms bullish continuation, with a potential 30% upside toward $0.35–$0.38 if buying pressure persists.

Also Read: TRON Price Eyes Breakout as REX Files for 2x Leveraged TRX ETF