This week, the crypto market witnessed a bullish turnaround as the panic selling surrounding the global trade war subsided. Thus, the pioneer cryptocurrency, Bitcoin, surged past $95,000, which triggered a renewed recovery in the altcoin market. The Toncoin price analysis displays this behavior by forming a fresh higher-low formation at the $2.75 floor, signaling an initial change in investors’ sentiment.

TON Open Interest Spike Hints at Potential Breakout Rally

In the last two weeks, the Toncoin has shown a bullish recovery from $2.78 to $3.15 — a 15.3% increase. Consequently, the asset market surged to $8.04 billion.

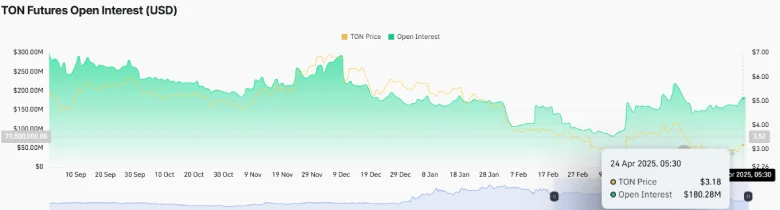

Following the price surge, the TON futures open interest bounced from $139 million to $182.5 billion, projecting a 31% surge. This sharp increase suggests fresh capital is entering the TON market, reflecting growing confidence and stronger conviction in the ongoing price trend.

When open interest rises alongside price, it typically points to a strong, more sustainable trend for testing a potential breakout.

Toncoin Price Analysis Hints Buy-the-Dip Sentiment is Back

Toncoin, the native cryptocurrency of The Open Network (TON), has severely underperformed compared to the broader market since last year. The daily chart analysis shows a price fall from the $8.28 high to the $3.15 current trading value, registering a 62% fall.

Before Toncoin reclaimed the $3 floor, the daily chart showed a bottom reversal at $2.35, followed by a higher low at $2.85. This new support accentuates the increasing strength of market buyers as they have prevented a return to $2.35.

If the bullish momentum persists, the coin price will likely breach the combined resistance of $3.26 and the 50-day exponential moving average. The potential breakout will signal buy-the-dip sentiment returning among investors while bolstering a 41% surge to breach the horizontal resistance of $4.5.

However, the overhead resistances of the 100-and-200-day EMA slope suggest the broad market sentiment is bearish. Thus, the coin price will face occasional pullbacks before challenging the $4.5 barrier.

Also Read: ETH Breaks Out of Multi-Month Falling Wedge – Can History Repeat?