- The Ethereum price gave a decisive breakout from the resistance trendline of a symmetrical triangle pattern.

- Tom Lee’s BitMine acquired roughly 24,000 ETH through FalconX.

- Mid-January spikes showed inflows reaching up to 481,000 wallets in 24 hours.

- ETH fear and greed index at 60% accentuate a renewed bullish sentiment in the market.

On Thursday, January 16th, the Ethereum price plunged 1.7% to trade at $3,297. The pullback aligns with broader market pullback as lower than expected U.S. job less claims reduced odds of near-term Federal Reserve rate cuts. However, the downtick in ETH price is testing key support levels amid active institutional accumulation and sharp spike in new wallets engaging with the Ethereum network. Is a leap to $3,500 close.

Ethereum Adoption Explodes as BitMine Locks Billions Into ETH Staking

Following the early week recovery, the Ethereum price witnessed bearish pullback from $3,400 resistance and plunged to $3,286. I8.

However, Large holders continued to pile up on their Ethereum positions in the face of short-term market softening. Blockchain records reveal that Bitmine, the Ethereum treasury outfit, chaired by Fundstrat’s Tom Lee — took delivery of some 24,000 ETH, worth almost $80.6 million, through an institutional desk at FalconX.

Bitmine has focused major resources on Ethereum’s staking layer. Recent moves saw over $600 million worth of ETH locked, taking its committed stake to near $5-6 billion. This makes the company one of the network’s heaviest participants with staked assets accounting for a large chunk of its overall balance sheet, now open metrics indicate expanding participation beyond established users.

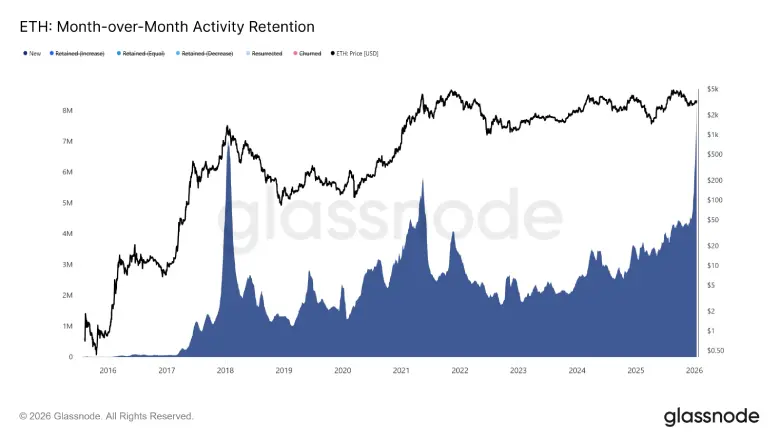

Ethereum’s on-chain data shows a significant increase in new participants in the last 30 days. Analytics from Glassnode’s Month-over-Month Activity Retention chart shows an elevated “New” cohort with the blue area at the bottom showing a notable increase in early 2026 compared to previous months.

This uptick is in line with record levels of day to day address creation. Over the last week, averages were in the neighborhood of 327,000 new addresses a day; a peak of 393,600 on January 11 – the highest day’s total on record. Subsequent days were filled with continued high inflows with reports of up to 481,000 new addresses in 24 hours around mid-January.

Ethereum Price Eyes $3,700 as Buyers Exited two Month Consolidation

Over the past two months, the Ethereum price showed a short-term consolidation trend, resonating within two converging trendlines. These two slopes act as dynamic resistance and support for price, revealing the formation of symmetrical trend patterns.

The chart setup is commonly spotted in an established trend as the consolidation typically allows price to replenish the prevailing momentum and suitable breakout. On January 13th, the coin price gave a bullish breakout from triangle pattern signaling an initial change in market momentum.

The daily RSI slope back above 65% the accentuated long recovery momentum in price , supporting a potential breakout. A fresh bullish crossover between the 20-and-50-day exponential moving average further accentuates the building bullish momentum in price.

If the breakout holds, the Ethereum price could rally 12% to reach $3,660 resistance.

On the contrary note. If the altcoin fails to sustain above the breached resistance, the ETH price could revert within the triangle pattern and face a prolonged consolidation trend ahead.

Also Read: $40B Exits Altcoins as Shorter Bull Runs Signal Investor Shift