Key Highlights

- BitMine revealed its combined holdings, revealing that its combined holdings have surpassed a total value of $11.8 billion.

- Tom Lee stated that the company does not believe crypto prices have peaked for this ‘cycle’

- Based on five explanations for the crypto price cycle, he affirmed that a crypto cycle top is likely 12-36 months away.

BitMine, the leading Bitcoin mining company, has revealed its Ethereum holdings, saying that its combined holdings have reached a total value of $11.8 billion. This figure includes its cryptocurrency assets, cash reserves, and strategic investments in other companies.

BitMine Immersion (BMNR) reported total crypto and cash holdings of $11.8 billion, including roughly 3.5599 million ETH, representing about 2.9% of ETH’s circulating supply. Chairman Tom Lee said recent market weakness may stem from constrained market-maker liquidity, but expects…

— Wu Blockchain (@WuBlockchain) November 17, 2025

The company’s detailed portfolio shows it holds a staggering 3,559,879 Ethereum (ETH) tokens. According to the current market rate of ETH, this Ethereum holding alone is worth over $11.21 billion.

Apart from this, BitMine also owns 192 Bitcoin and maintains $607 million in unencumbered cash. The company also holds a $37 million stake in Eightco Holdings, which it classifies as one of its “moonshots” investments.

Tom Lee Sees Crypto Peak Still 12 to 36 Months Away

In a statement, BitMine Chairman Tom Lee directly shared his views on the current market cycle. “But we do not believe crypto prices have peaked for this ‘cycle’,” Thomas “Tom” Lee of Fundstrat, Chairman of BitMine, stated in a press release.

Lee explained that after reviewing five explanations for the crypto price cycle, the company has concluded that two factors hold major importance. Both of these indicators suggest that the top of the current market is likely still “ 12-36 months away.”

Tom Lee shared his views on the current crypto market conditions. According to him, the prices of cryptocurrencies have failed to recover since a catastrophic liquidation on October 10 after U.S. President Donald Trump announced heavy tariffs on China. Tom Lee suggests that this constant weakness in the crypto market shows that a market maker (or its wo) is suffering from a crippled balance sheet.

Tom Lee said, “When a market maker has a ‘hole’ on their balance sheet, they are seeking to raise capital and are reducing their liquidity functions in the market. This is the equivalent of QT (quantitative tightening) for crypto and has the effect of dampening prices. In 2022, this QT effect lasted for 6-8 weeks. And this is probably happening today.”

BitMine Optimistic on ETH Future with Stablecoins & Tokens

The report also highlights fundamental factors that help Ethereum become one of the robust networks in the future. These include the upcoming Fusaka upgrade and a continued surge in the use of stablecoins.

A major point of focus is the advancement of tokenization, where traditional assets like stocks, bonds, and real estate are represented as digital tokens on the Ethereum network.

“Tokenization is a major unlock for asset markets as it is more than just fractionalization or 24/7 liquidity. It is the innovation driven by the factorization of an asset by time, product or geography. , This, in turn, will provide great market transparency for issuers and investors,” said Tom Lee.

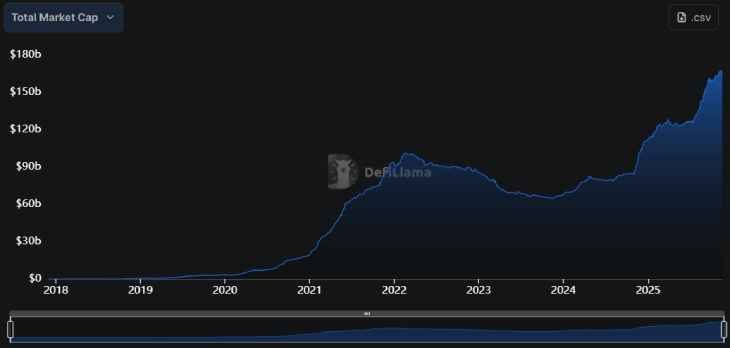

(Source: DefiLIama)

Apart from tokenization, the boom in the stablecoin market and Ethereum’s unmatched dominance are other big things that could provide it an edge over other networks, according to Tom Lee. At present, the total market capitalization of the stablecoin market stands around $303.941 billion, and Ethereum alone contributes $165.118 billion, which is over 54.34%, according to DefiLIama. Some major stablecoins like USDT and USDC are also Ethereum-based. According to a Citi report, the stablecoin market is expected to grow by $1.9 trillion.