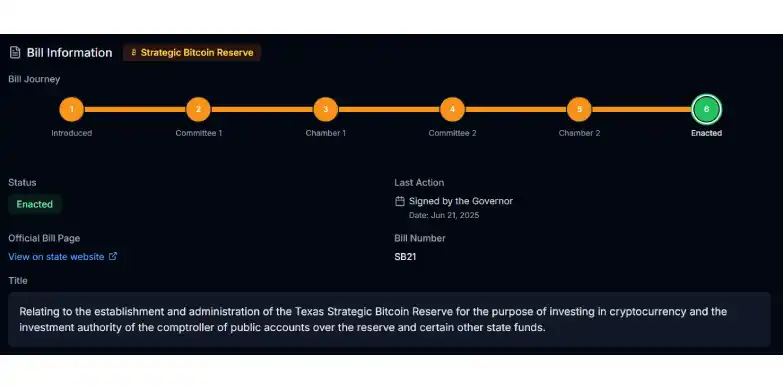

Texas has taken a pioneering step in crypto space by becoming the first US state to create a publicly funded, stand-alone bitcoin reserve. Governor Greg Abbott signed Senate Bill 21 into law, officially directing the creation of the reserve, which will be managed independently from the state’s main treasury.

Texas’s Bitcoin Reserve Bill

What sets Texas apart from other states like Arizona and New Hampshire, both of which have passed similar legislation, is that Texas is not merely authorizing the concept but actively investing in it. The state has allocated $10 million to purchase bitcoin, signaling a concrete commitment to digital asset adoption.

While this $10 million represents only 0.0004% of Texas’s overall budget, the symbolic value is far greater. “It sends a clear message to investors and entrepreneurs that Texas recognizes the digital future of finance,” said Lee Bratcher, president of the Texas Blockchain Council.

Strategic Bitcoin Reserve is now law in the state of Texas.

— Dennis Porter (@Dennis_Porter_) June 21, 2025

This move follows recent federal efforts, including the Trump administration’s proposal for a national crypto reserve. However, unlike Texas’s direct investment approach, the federal initiative is expected to rely on budget-neutral strategies such as seized crypto assets or issuing digital bonds.

In tandem with SB 21, Abbott also signed House Bill 4488, a companion law that protects the newly established bitcoin reserve from being swept into general revenue through standard budget procedures, which ensures it remains a dedicated financial asset.

Bitcoin is past the recognition of a speculative instrument and has increasingly become the government’s choice as sovereign-grade financial holdings with long-term strategic value. The state of Arizona might soon become the second US state to have a Strategic Reserve as its Bitcoin bills have recently been revived after the state’s Senate passed a motion to reconsider the bill on Thursday. Titled, ‘HB 2324’, if Arizona’s bill passes, the first $300,000 worth of digital assets in a criminal forfeiture would go to the Attorney General’s office.

The exceeding account would be split 50% with the Attorney General, 25% to the state general fund and 25% to the new digital assets reserve fund.

The crypto is currently trading at $105,125.19, after a jump of over 4.35% in the past day. On June 23, Bitcoin (BTC) surged above $105,000 with a 4.79% hike in 24 hours, right after Iran and Israel agreed to a ceasefire within 6 hours. US President Donald Trump has shared this update on Truth Social. This surge was back after briefly crashing below $100,000 earlier that same day.

Also Read: Bitcoin’s 4-Phase Pattern Hints at a Stunning $175K Run