On Friday, July 4th, the crypto market recorded a sudden sell-off as Bitcoin reversed sharply from $100,000. A majority of major altcoins, including SUI, followed this momentum, signaling a renewed correction trend in the market. However, the SUI price bounced immediately as its DeFi options and derivative market speculation continued to grow. Is a rally to $3.5 next?

DeFi Ecosystem Shows Resilience Amid Market Dip

In the last two weeks, the SUI price experienced notable growth, rising from a low of $2.29 to a high of $3.08, representing a 34.7% increase. While the intraday sell-off has pushed the coin price to $2.87, the network activity highlights sustained growth in DeFi operations.

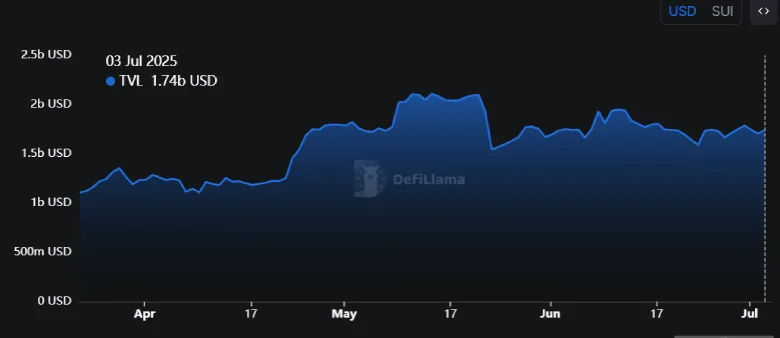

According to DefiLlama data, the SUI total volume locked also bounded from $1.59 billion to $1.8 billion, registering a 13% increase. The rising TVL suggests more users are locking their assets into SUI’s DeFi protocol, with the potential for yield farming, lending, or staking.

In addition, the SUI futures open interest also bounced from $1.13 billion to $1.37 billion—a 23% surge. Typically, it accompanies the volatility and price discovery phases, indicating that both bulls and bears are gearing up for larger moves.

SUI at Crossover as Flag Breakout Under Question

Since mid-May 2025, the SUI price has shown a steady correction under the influence of a bull flag pattern. Generally, the downtrend within this pattern is temporary, as it provides buyers an opportunity to regain bullish momentum.

On July 3rd, the coin price broke out of the pattern’s resistance trendline, signaling the continuation of the prevailing recovery. However, with today’s 5% drop, the SUI coin signals the risk of failing this flag breakout and reentering the correction phase.

The daily candle shows a long-tail rejection at the $2.7 floor, accentuating that buyers continue to defend this level. If the support holds, the SUI buyers could build sufficient momentum and drive a rally to $3.56, followed by a leap to $4.3.

On the contrary, if the coin price reverts from the channel resistance, its breakdown below today’s low of $2.7 would intensify the bearish momentum and set a fall to $2.39.