On Tuesday, July 8th, the SUI price surged 1.3% to trade at $2.88. Despite the uptick, the daily chart displays a neutral candle formation, suggesting a lack of bullish momentum to sustain the current recovery. This intraday consolidation stands at a key pivot level of wedge pattern support, signaling a potential for reversal or risk of bearish breakdown. $3.2 or $2.5; where is the SUI price heading by the end of July?

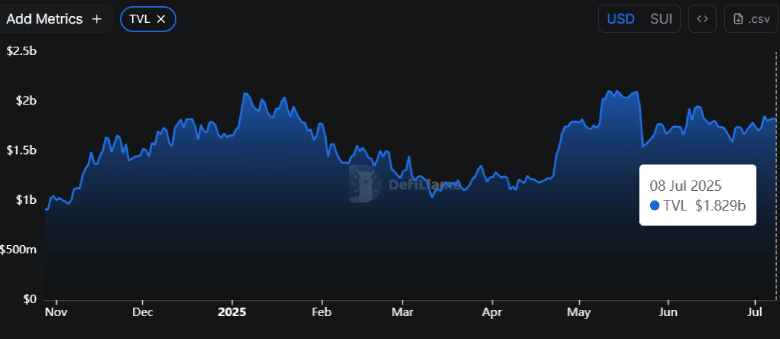

DeFi TVL Recovery Supports Bullish Narrative

Over the past two weeks, the SUI price has shown a bullish reversal from $2.29 to its current trading value of $2.9, projecting a 26% surge. Along with broader market uptake, the SUI price gained momentum from the recovering trend in total volume locked (TVL).

According to DeFiLlama data, the SUI TVL has increased from $1.59 billion to $1.82 billion, registering a 14.5% rise within a fortnight. This growth in locked assets suggests that liquidity and user trust are returning to SUI-based decentralized finance (DeFi) protocols.

Unlock speculative pumps, the increase price with TVL growth could sustain its level as it indicates genuine ecosystem growth. If the trend remains, the SUI could gain additional momentum and drive a bullish breakout.

SUI at a Crossroads Amid Wedge Pattern Formation

The four-hour chart analysis of SUI shows that the recent price recovery has resonated strictly within two converging trendlines, forming a rising wedge pattern. Typically, this pattern is observed in an established downtrend, offering traders a slight relief rally to reincorporate the bearish momentum.

By press time, the coin price trades at $2.89, seeking support at the pattern’s lower boundary. If the price breaks below the support trendline, the selling pressure would escalate and drive a prolonged correction to $2.64, followed by $2.4.

On the contrary, if the price manages to breach the immediate resistance of $2.93 with their 4-hour candle closing, the buyers could drive another recovery lead of 11% to hit $3.26.

Also Read: Solana Price Holds Above Critical Support—Is a Move to $180 Next?