- The SUI price drives a long-term sideways trend resonating within the formation of a symmetrical triangle pattern.

- In the last three weeks, the open interest tied to SUI futures plunged from $1.84 billion to $891 million, projecting a declining speculative force.

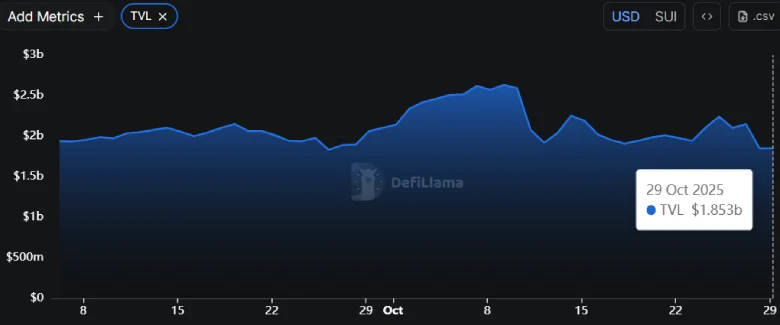

- SUI’s TVL is down to $1.85 billion, suggesting a slowdown in protocol activity and a notable drop in capital allocation in DeFi services.

SUI, the native cryptocurrency of the SUI ecosystem, plunged over 4% during Tuesday’s U.S. market hours. The selling pressure followed a slowdown in broader market recovery as the Bitcoin price faces overhead supply at $116,000. However, the sellers strengthened their grip on the SUI price amid a continuous decline in its Total Value Locked (TVL) in DeFi and a slowdown in speculators’ demand. Is this coin heading for the $2 mark?

Sui Faces Steep Correction with Futures OI and TVL Down

In the last three weeks, Sui has seen a significant decline in both market performance and network activity. The token, which traded at around $3.71 earlier this month, is now trading at around $2.46—a pullback of almost one-third of its value. Similarly, the market capitalization has dipped to around $9.06 billion, which is indicative of the general sentiment of prudence prevailing within the altcoin markets after the massive crypto deleveraging event on October 10.

Futures data also shows how much the retreat has already spread. Sui derivatives‘ notional value of open interest has declined by nearly half, from roughly $1.84 billion to $891 million. The contraction reflects a steep contraction in leveraged positions as traders ease off exposure as the market faces increased volatility and lower liquidity.

The same pullback has been reflected in the fundamentals of the network. According to DeFiLlama data, the overall value of Sui’s TVL has plunged from $2.56 billion to $1.85 billion, registering a 28% loss. The decline in DeFi participation is an indicator of a decline in protocol activity and a temporary decrease in capital allocation across Sui-based lending, staking, and yield platforms.

The confluence of spot valuation, derivative interest, and on-chain liquidity decline sees Sui join a number of digital assets going through a phase of heavy risk reduction. While core development is ongoing within the ecosystem, recent on-chain and market data indicate that investors are taking their portfolios more defensively, reducing positions, and taking gains after a volatile October.

SUI Price To Extend Correction Within Triangle

Today, the SUI price plunged over 4% to currently trade at $2.49. This price decline, coupled with a 5% jump in 24-hour trading value currently recorded at $1 billion, indicates a strong conviction from sellers to prolong this correction.

The daily chart shows a sharp decline in fast-moving exponential moving averages, such as 20 and 50, indicating aggressive bullish momentum. In addition, a recent bearish crossover between the 100 and 200-day EMAs accentuated the bearish sentiment in the market.

With sustained selling, the coin price is poised for another 24% decline to test the bottom trendline of a symmetrical triangle pattern at $1.9. Since October 2024, the SUI price has been resonating within two converging trendlines of the triangle.

Theoretically, this large consolidation within a narrowing range should allow traders to recuperate their prevailing momentum for the next major move. The recent history of this pattern shows that a bullish reversal from the bottom trendline has bolstered a recovery trend ranging from 158 to 233%.

Thus, the potential retest of triangle support stands as a pivot level for SUI traders.

Also Read: Western Union to Launch USDPT Stablecoin on Solana by 2026