On Thursday, March 27, the SUI price jumped +6% to reach a current trading value of $2.7. The buying pressure followed a broader market uptick as panic selling surrounding the United started tariff started to diminish. Amid the price recovery, the SUI coin records a notable surge in training volume, total volume locked (TVL), and open interest (OI), reinforcing its opportunity for higher rally.

Key Highlights:

- A falling wedge pattern drives the current correction trend in AAVE.

- The 200-day Exponential Moving Average wavering around $3 level, creates a high-momentum swelling zone for AAVE trades.

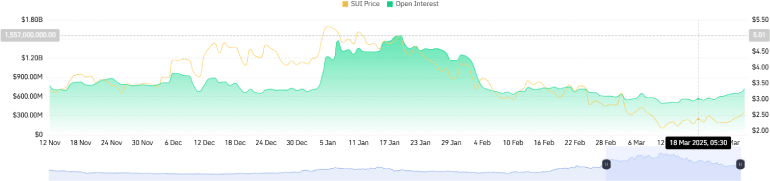

- In the last two weeks, Total volume locked (TVL) in the SUI network grew by 22.3%, while Futures Open Interest rose by 46.3%.

TVL and Open Interest Surge Suggest Continued Momentum

In a six-day recovery, the SUI price jumped from $2.23 to $2.76 current trading value, registering a 24% growth. The upswing backed by increasing trading volume hints at growing conviction from buyers to drive a sustained recovery.

Simultaneously, the Total Volume Locked (TVL) of SUI network surged from $1.03 Billion to $1.26 Billion — a 22.3% increase, according to DeFiLlama data. This uptick suggests more assets are being locked into the network, pointing to stronger utility and adoption.

Furthermore, the SUI Futures Open Interest has also rallied from the recent bottom of $491.7 Million to $719.7 Million, projecting a growth of 46.3%. The significant growth indicates that traders are expecting higher volatility or are positioning for further price movement, potentially signaling continued bullish sentiment.

These indicators combined suggest strong bullish momentum and growing market conviction for SUI.

Also Read: Crypto Sleuth: PancakeSwap May Launch IDO using CAKE Token

SUI Price Prepares Key Resistance Breakout For New All-Time High

The SUI price analysis of the daily chart shows a V-shaped recovery from a $2 psychological level to $2.7 — a 42% surge — over the past weeks. The bullish upswing breached the dynamic resistance of the downsloping trendline and 20-day EMA slope.

Over the past months, the SUI price has failed to sustain above the EMA slope which immediately resulted in continued market correction. Thus, the recent breakout hints at an initial change in the market dynamic.

If the buying pressure persists, the coin price could surge 23% up to challenge another key resistance of $3.4. The potential breakout will act as a suitable stepping stone for buyers to drive a rally past $5.3 All-Time High.

However, if sellers continue to defend the overhead resistance trendline, the SUI price reverts for another market downturn.

Also Read: Here’s Why Ethereum Price Correction May Bottom At $2,000