Key Highlights:

- Starknet’s STRK surges 26% today, November 19, 2025.

- The project has staked more than 1,267 BTC worth more than $100 million.

- Critical support level hovers around the $0.20 mark

Starknet’s native token STRK has experienced a great jump of 26% today, November 19, 2025. This rally can be attributed to the staking activity that was carried out in the past week. The project has managed to stake more than 1,267 BTC which are valued at more than 100$ million. This number indicates that there has been an increase of 50% in the staking volume, which is huge for the project.

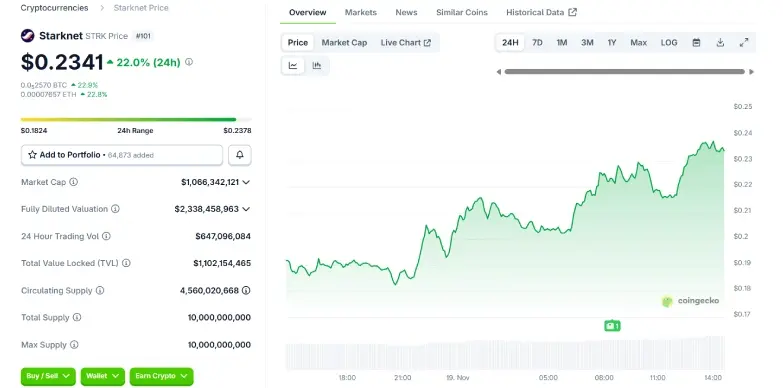

At press time, the price of the token stands at $0.2341 with an increase of 22.0% in the last 24 hours as per CoinGecko.

Network Value and User Engagement Reach New Heights

The increase in Bitcoin staking has provided a strong push to Starknet’s on-chain activity. The network’s total value locked (TVL) has climbed up to $1.1 billion, which indicates increasing trust and usage. Starknet is also seeing solid daily engagement as there has been more than 100,000 active users and cumulative trading volume above $1.5 trillion. Both of these numbers are indicating towards the growing strength as a leading Layer-2 rollup, that offers fast throughput and secure, scalable infrastructure.

STRK Token Rally: A Reflection of Network Expansion

Along with these developments, Starknet’s native token has also managed to hit record and jumped 100% in the last 30 days and is currently hovering around the $0.23 mark. The reason for this surge is increased staking activity and growing confidence among users and investors. As of now, more than 900 million STRK (20% of the circulating supply), is staked on the network.

As a considerable amount of tokens are staked on the network, the liquid supply of STRK tokens decreases and makes the token more scarce. When more STRK is staked, more and more people lock their tokens to take part in network decisions as staking gives users voting power in governance. So more the staking activity, more people are involved in choosing upgrades, protocol changes and fund allocation.

At the same time, staked tokens cannot be sold immediately, which encourages long-term holding. This reduces short-term selling pressure and supports a more stable, committed community of users who are actively invested in the network’s growth.

BTCFi: Merging Bitcoin’s Security with Layer 2 DeFi Innovation

The BTCFi initiative is one of Starknet’s most important innovations. It lets users stake Bitcoin on Starknet in a trustless way, without relying on custodians. By allowing BTC to be staked along with STRK, the network uses a dual-token system that strengthens security and brings Bitcoin deeper into Ethereum’s DeFi ecosystem. This gives BTC holders new ways to earn yield that are directly linked to network security and participation.

BTCFi is also supporting a lot of products, which includes borrowing and lending with BTC collateral, BTC-backed stablecoins, and easy yield strategies that improve capital efficiency.

The project has developed staking rewards, token distribution and ecosystem incentive all working together, Starknet has built a strong growth cycle that keeps attracting more users and developers to the network.

Future Outlook

Analysts highlight that it is important for STRK to stay above the key support level of $0.20, especially while Bitcoin’s price is moving up and down. The token could see big gains if it manages to grow its ecosystem (get more stakers and institutional investors on-board). This would help Starknet strengthen its position as one of the major projects driving the next phase of DeFi growth.

Also Read: STRK Drops 13% After Rally, Profit-Taking & Unlock Loom