Key Highlights

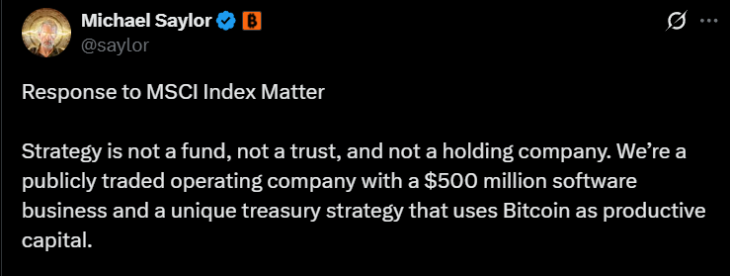

- In the latest post on X, Michael Saylor has responded to the current controversy around the MSCI Index

- He stated that Strategy is not a fund, not a trust, and not a holding company.

- He mentioned that index classifications do not define the company by highlighting conviction in Bitcoin

Amid the ongoing buzz around the MSCI Index controversy, Strategy’s Michael Saylor finally broke the silence in his latest post on X (formerly Twitter), saying Strategy is not a fund, not a trust, and not a holding company. He cleared the fog around the company’s status, calling it a publicly traded company with a unique treasury strategy that uses Bitcoin as productive capital.

(Source: Michael Saylor on X)

What is the MSCI Index Matter

The controversy completely revolves around Strategy’s massive Bitcoin treasury. Led by executive Michael Saylor, the firm has accumulated 649,870 Bitcoin, representing around 3% of the total supply.

This strategy has made its stock a popular proxy for investors who seek Bitcoin exposure. The company’s business model combines its traditional software revenue with an aggressive strategy of acquiring Bitcoin, often funded by issuing debt and selling new stock. This success has opened doors and led to its inclusion in major stock market indices, which poured billions of dollars in passive investment into the company and, by extension, into Bitcoin.

But the controversy sparked when the global index provider MSCI began reviewing how to classify companies like Strategy. New proposed rules would label firms holding more than 50% of their assets in cryptocurrency as digital asset treasuries, as it categorized similarly to investment funds.

This classification would make them ineligible for inclusion in MSCI’s main equity indices.

For Strategy, the main issue is that while the company is an operating business, the vast majority of its value, in Bitcoin holdings worth over $54 billion. This financial nexus has blurred the line between a company and a fund.

Some analysts at JPMorgan have warned that if MSCI decides to remove Strategy from its indices, it could start immediate outflows of around $3 billion from the stock.

This could balloon to over $8.8 billion if other providers like Nasdaq follow suit.

This catastrophic event would damage the company’s ability to raise capital and could erase the premium its stock currently holds.

Michael Saylor’s Remark over MSCI Index

In response, Michael Saylor has shared a post to address the ongoing debate over his company’s classification. He directly refuted the idea that his company is a passive fund, stating that Strategy is not a fund, not a trust, and not a holding company.

“We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital,” stated in the post.

He mentioned that the company has completed 5 public offerings of digital credit securities this year alone. These offerings represent a total notional value of over $7.7 billion, which includes instruments named $STRK, $STRF, $STRD, $STRC, and $STRE.

“Funds and trusts passively hold assets. Holding companies sit on investments. We create, structure, issue, and operate. Our team is building a new kind of enterprise—a Bitcoin-backed structured finance company with the ability to innovate in both capital markets and software,” he stated.

“Index classification doesn’t define us. Our strategy is long-term, our conviction in Bitcoin is unwavering, and our mission remains unchanged: to build the world’s first digital monetary institution on a foundation of sound money and financial innovation,” he said.