Key Highlights

- The biggest Bitcoin-holding public company, Strategy, has announced the acquisition of 1,229 Bitcoin ahead of a rally in the cryptocurrency that pushed it above $90,000

- Metaplanet has also revealed its plan to accumulate 210,000 Bitcoin by the year 2027

- Despite this bullish news, historic outflows in BTC ETFs during Christmas Eve have sparked concern in the crypto community

On December 29, the biggest Bitcoin holding company in the world, Strategy, announced the acquisition of 1,229 Bitcoin, worth of $108.8 million.

Strategy has acquired 1,229 BTC for ~$108.8 million at ~$88,568 per bitcoin and has achieved BTC Yield of 23.2% YTD 2025. As of 12/28/2025, we hodl 672,497 $BTC acquired for ~$50.44 billion at ~$74,997 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/5VvOgBYwhk

— Michael Saylor (@saylor) December 29, 2025

The announcement comes at the crucial time of the end of the year, when BTC has already witnessed a strong sign of recovery after surging above $90,000.

With the latest acquisition, Strategy now holds over 672,497 BTC acquired for approximately $50.44 billion at $74,997 per Bitcoin.

Bitcoin Treasuries Look Bullish Pre-New Year, While BTC ETFs Drop

As the world is preparing to welcome the new year 2026, many financial institutions and Bitcoin holding companies are preparing to expand their Bitcoin holdings under their new year’s resolution.

The announcement comes after Michael Saylor’s latest post on X, saying Back to Orange.

During an Extraordinary General Meeting held on December 22, every single one of the five proposals presented to investors was approved unanimously. The approval clears the way for Metaplanet to pursue its goal of accumulating 210,000 Bitcoin by the year 2027, which would equal roughly 1% of the cryptocurrency’s entire supply.

The approved proposals are mainly focused on restructuring the company’s capital to enable large-scale fundraising. The purpose is to raise money to buy BTC without causing immediate and major dilution for existing common shareholders. The major changes involve the company’s preferred shares, which are special classes of stock aimed at institutional investors.

Shareholders agreed to double the number of authorized preferred shares, creating up to 555 million of both Class A and Class B shares. The Class A shares, branded as MARS, will offer floating monthly dividends to provide a stable yield. The Class B shares are targeted at overseas institutions and include specific investor protections, such as the right to sell the shares back if the company does not go public within 1 year.

The company also reallocated internal capital reserves and amended its Articles of Incorporation to support these new financial tools. A major technical change was the drastic reduction of the company’s stated capital stock to just one Japanese Yen.

While treasuries are preparing to scoop BTC in the new year, BTC exchange-traded funds (ETFs) are still going through turmoil as they witnessed major outflows in the past week.

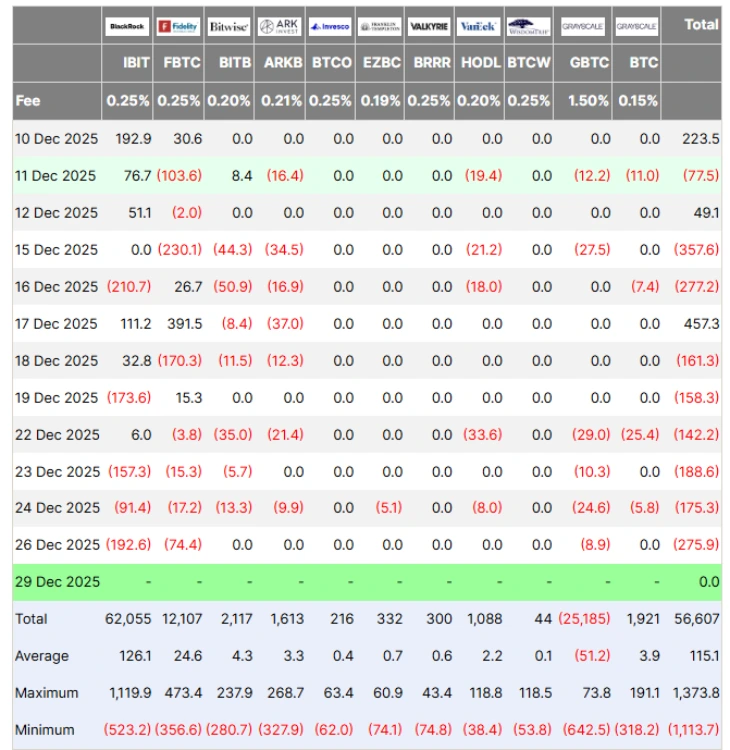

According to data on Farside, investor withdrawals from BTC ETFs continued through the Christmas week, which shows a negative sentiment in the cryptocurrency market. Investors based in the United States were the largest net sellers of BTC during this time.

According to experts, there are two major pressure points behind this historic outflow in these ETFs. These are seasonal sales for tax purposes and the expiration of large derivatives contracts, which can create increased market volatility.

(Source: Farside)

Despite the constant outflows, experts still believe that this trend is a temporary, seasonal occurrence rather than a sign of a deep problem with the asset.

On Christmas Eve, a day with a shortened trading session in the United States, the spot Bitcoin ETFs still recorded net outflows of $175.3 million.

This Christmas Eve result was not an isolated event. It is linked to the fifth trading session in a row where the funds experienced more money leaving than entering. Over the course of those five consecutive days, the total net outflows from U.S. spot Bitcoin ETFs reached $825.7 million. If added to the outflow on December 26, this figure reached $1,101.6 million in the total outflows.

Also Read: Bitcoin Bounces, Analysts Say Altcoins Struggle to Catch Up