Key Highlights:

- STBL token skyrockets 470% after revealing three-token stablecoin model.

- The price of the token hit a new all-time high today.

- The token’s sharp rise has sparked excitement and questions.

STBL, a governance token that is tied to a new experimental stablecoin system, has experienced a surge of 470% in the last 24 hours. The token also hit a new all-time high of $0.2352 today, September 17, 2025. Both of these developments have put the token on trader’s radar as bullish hype collides with nagging questions about sustainability.

At press time, the price of the token stands at $0.1927 with a surge of 459.92% in the last 24 hours as per CoinMarketCap.

The Catalyst: A Three-Token Stablecoin Model

The price surge happened after STBL launched its beta decentralized app (dApp) on September 15, along with three new token systems that are focused on shaking up the $150 billion stablecoin market. This setup separates the stablecoin’s basic function from how it generates yield, and includes:

- USST: A stablecoin that is meant for daily spending, which basically means that it can be used as digital cash. Its value is kept steady (pegged to the U.S. dollar), so people can use it for regular payments without worrying about the price swings.

- YLD NFTs: These are special tokens that help you earn rewards or yields. They let you keep collecting returns even if you spend your stablecoins.

- STBL: It is the main token that runs the system. Owning this token means you have both a say in how the ecosystem develops and a cut of the money it makes.

This innovation allows users to spend stablecoins and still earn yields. This situation provides a solution to the long-standing “yield versus utility” trade-off in stablecoin design. This initiative, which is led by Tether co-founder Reeve Collins and the project’s credibility has drawn a significant amount of attention from the community. The analysts are speculating that if the adoption of this token increases, it could reshape DeFi’s stablecoin landscape.

ATH Momentum Turns in FOMO Fuel

STBL finally launched on Binance Alpha after two delays and went live on Kraken the same day (September 16). And today, the token managed to hit a new all-time high at $0.2352, with trading volume exploding into the hundreds of millions of dollars. This number is huge when compared to its market cap of about $90-100 million, which shows how fast the money was being circulated.

It can be seen that excitement grew only after Binance announced STBL futures contracts today, which gave traders another way to bet on the token.

As the news spread, retail FOMO kicked in, and that is what drove the price higher before pullbacks followed. These swings highlight just how speculative the rally is, big gains that is powered by hype but drops just as easily.

Market Context: Riding the Altcoin Wave

The market environment has also helped the token. As of today, September 17, the Altcoin Season Index hit 69. This indicates that the investors are more willing to take risks and put money into new projects. STBL’s 470% jump fits into this notion just right. However, the trading numbers tell a different story, the daily volume was almost five times its market cap. This situation also indicates that most of the action came from short-term speculation rather than steady growth.

Risks: Tokens Unlocks and Fragile Liquidity

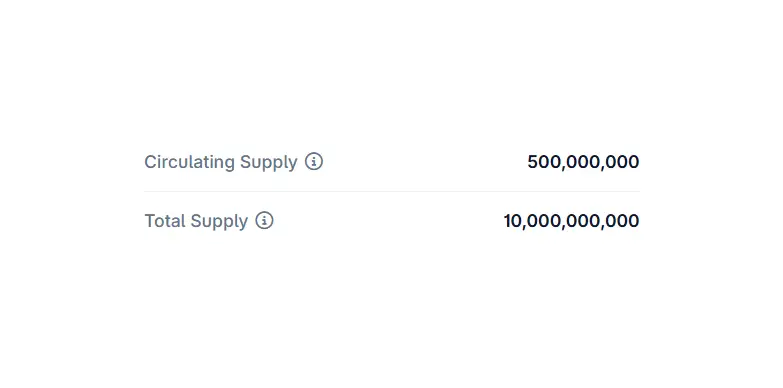

Even though the token experienced a great rally, risks still remain. It has to be kept in mind that only 5% of STBL’s 10 billion supply is currently in circulation. If large amount of unlocks take place with strong demand, the price of the token may face heavy dilution.

The huge trading volume compared to market cap also points towards a shaky liquidity. Here, big sell-offs could easily cause sharp drops. While the dApp includes a burn feature that is linked to USST use, it is still too early to know if it can keep the token stable.

The Road Ahead: Adoption vs. Speculation

As of now, STBL’s story seems to be balanced. The model also shows promise for DeFi users who want to spend stablecoins while earning yield. If the beta dApp draws real adoption and deposits, it could change how stablecoins work. But in the short term, price moves are mostly hype-driven and pushed by ATH buzz, altcoin season, and a small circulating supply that makes these swings extreme. Long-term success of the token will now depend on more people actually using it, not just its price going up.

Also Read: STBL Arrives on Binance Alpha on Sept 13; Here’s All