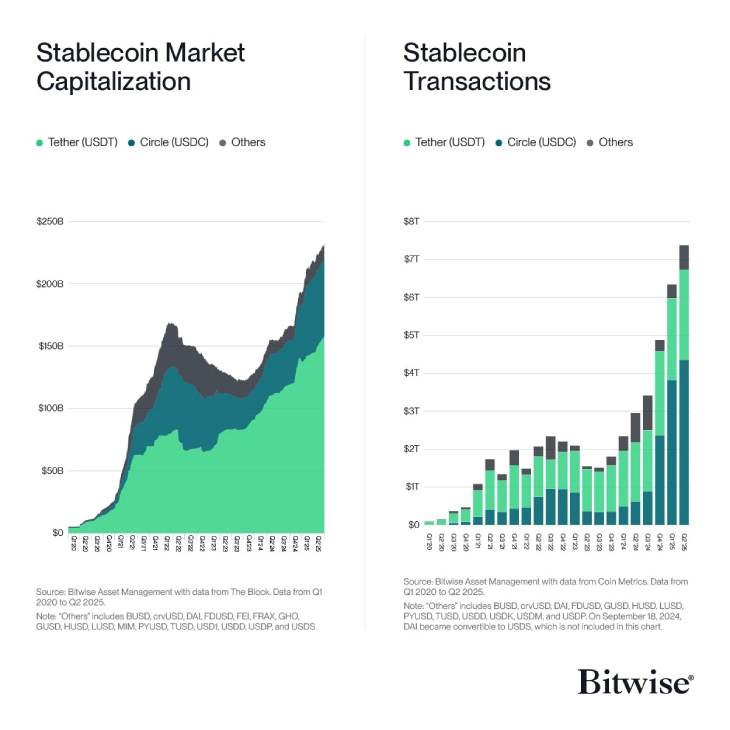

On July 28, 2025, Bitwise shared a post on X (formerly Twitter) with statistics on stablecoin market capitalization and transactions, stating, ‘Stablecoins are going parabolic.’

(Source: Bitwise on X)

Stablecoins to Reach $2 Trillion Market Cap in 2028

Over the past few years, the adoption of stablecoins has steadily increased. Additionally, the US stablecoin market is witnessing big changes after the GENIUS Act became law on July 18. This new federal legislation creates clear rules for stablecoins backed by the US dollar.

Eswar Prasad, Professor of Economics at Cornell University, said that the GENIUS Act is giving a legitimacy boost to the stablecoin market.

In just one week after the law passed, the total value of all stablecoins grew to around $264 billion with a $4 billion jump, according to MacroMicro. This rapid growth shows that banks and financial institutions are gaining confidence in stablecoin with growing regulatory clarity.

The stablecoin market is expected to reach $2 trillion by 2028, with USD-pegged stablecoins dominating 90% of the total circulating supply. Monthly transaction volumes have surged to $700 million across 120 million transactions.

Stablecoins have become the top way in online transactions, moving more money than Visa and Mastercard, says Noam Hurwitz of Alchemy. He calls this growth “explosive,” noting stablecoins are becoming the go-to system for digital payments.

Big payment companies like PayPal, Stripe, and Robinhood now use stablecoins to make transactions faster and cheaper through blockchain technology. They’ve also become major buyers of U.S. government debt as Tether alone made $13 billion profit last year from these investments.

Amid a positive shift in the regulatory side, the US stablecoin market is likely to see exponential growth in the upcoming months as many financial institutions are planning to integrate this innovation into their traditional financial infrastructure.

The latest report revealed that some big US banks are planning to launch their own stablecoins, including Bank of America and Citibank.

BofA CEO Brian Moynihan said, “We feel both the industry and ourselves will have responses. We’ve done a lot of work. We are still trying to figure out how big or small it is, because in some places there are not big amounts of money movement. So you would expect us all to move, our company to move on that.”

In July 2025, the global transaction volume crossed the $8.9 trillion mark in on-chain volume for the first half of 2025. As of now, Tether holds the top spot as the leading stablecoin with a market capitalization of $163.59 billion, followed by USDC with $63.88 billion.

Also Read: US SEC Postpones Decision for Truth Social Spot Bitcoin ETF