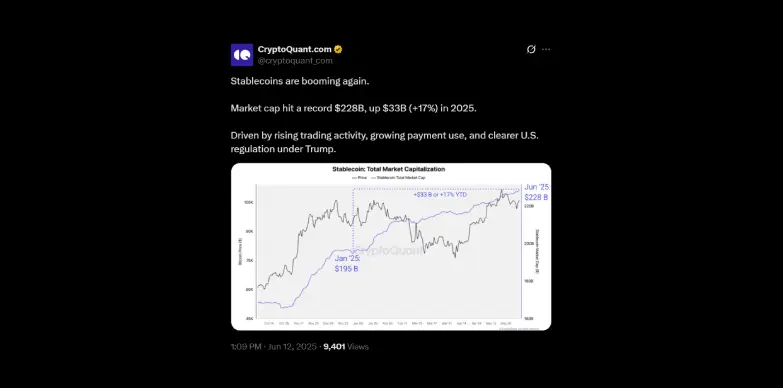

The stablecoin market is on a tear in 2025 with total capitalization jumping from $195 billion at the start of the year to $228 billion in June as per Crypto Quant. This indicates that there is an increase of 17%, a new all-time high. This surge is driven by rising demand for digital payments, increased trading activity, and a wave of institutional interest.

GENIUS Act: Road Towards Clarity on Stablecoins

The numbers only tell a part of the story. The U.S. Senate has just cleared a major hurdle for the GENIUS Act, a landmark bill that would introduce the first comprehensive federal framework for stablecoins. The procedural vote passed 68-30, signalling strong bipartisian support and making final passage likely. The GENIUS Act aims to bring clear rules for issuance, transparency, and reserve requirement, finally ending years of regulatory ambiguity that left the industry in limbo.

If enacted, the bill would require issuers to fully back their tokens with cash or short-term treasuries, submit to regular audits, and provide monthly public disclosures of reserves. Large issuers would need to operate under a bank-style charter, while consumer protections would be strengthened through statutory redemption right and oversight similar to money-market funds. The Act also includes anti-money laundering measures and gives regulators tools to monitor compliance and enforce sanctions.

Industry Leaders Speak

At the recent Apex 2025 conference, CoinMENA’s CEO Talal Tabbaa highlighted how tokenization is moving beyond hype. These coins are becoming part of institutional infrastructure, not just speculative tools. This growing institutional interest aligns well with the regulatory progress made by the GENIUS Act.

Market Reacts

Supporters argue that the GENIUS Act will give payment providers the clarity they need to innovate while protecting consumers and reinforcing the U.S. dollar’s dominance in digital finance. Critics, though, warn about potential risks to financial stability and the possibility of stablecoin issuers engaging in risky non-core activities.

This combination of market growth and clearer rules is encouraging. Stablecoins are no longer niche assets. They are becoming a key part of how money moves digitally. Analysts note that when stablecoin market caps hit new highs, it often also indicates strength in cryptocurrencies like Bitcoin.

As the stablecoin market approaches $250 billion and the GENIUS Act heads for a final Senate vote, the U.S. is poised to set the standard for digital asset regulation. This moment marks a turning point for both the industry and the broader financial system, as stablecoins move from the margins to the mainstream.

Also Read: Mercurity Fintech to Raise $800 Million for a Bitcoin Treasury Reserve