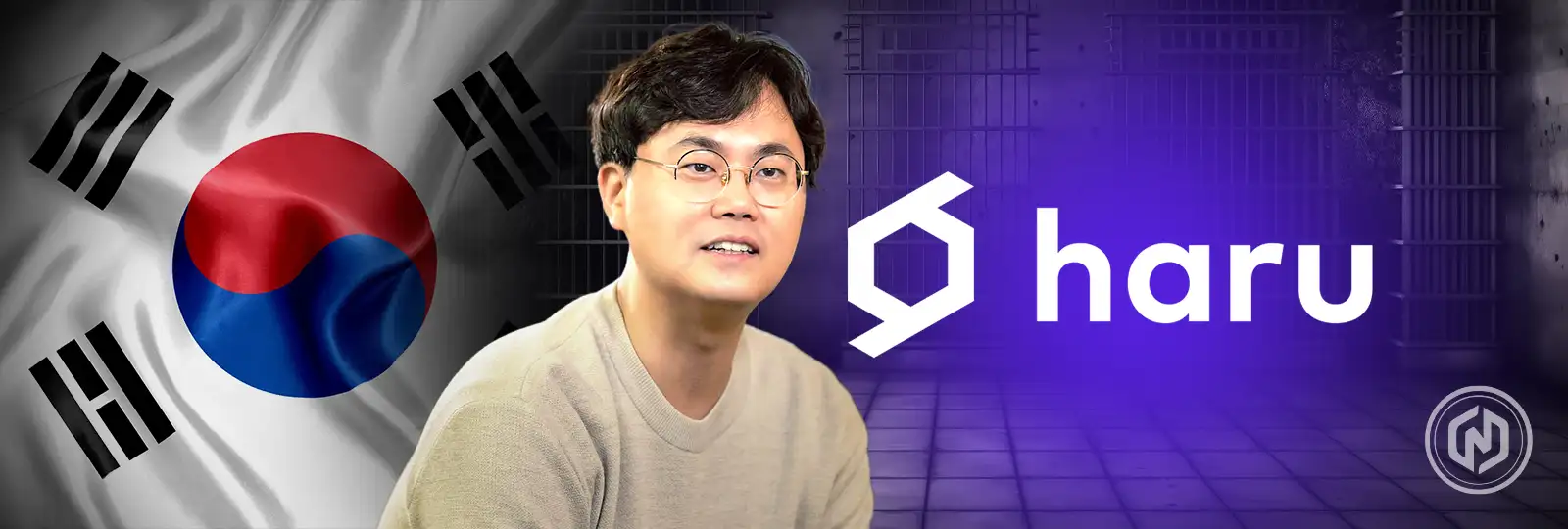

A South Korean court has acquitted Haru Invest CEO Lee Hyung-soo of fraud charges tied to the sudden collapse of the crypto yield platform in mid-2023. Lee was accused of deceiving investors by promising full principal returns and up to 25% annual interest, promises that were not fulfilled after the platform abruptly froze withdrawals and shut down operations.

South Korea’s Court Acquits Haru Invest CEO Lee Hyung-Soo

Prosecutors initially claimed Lee and his firm defrauded 16,000 investors out of 1.39 trillion won (about $1.02 billion), but later revised the figure to 880.5 billion won ($650 million) and sought a 23-year prison sentence.

In a shocking twist during last year’s trial, Lee was stabbed four times in the neck by an investor who allegedly lost 100 BTC in the collapse. The Seoul police reportedly arrested the attacker, who was a man in his 40s.

Lee survived the attack, and the assailant was sentenced to five years in prison this April.

The Seoul Southern District Court ruled on Tuesday that while Lee mismanaged the company, his actions did not legally qualify as criminal fraud. The court found that Haru’s downfall was closely linked to the wider liquidity crisis triggered by the FTX collapse. It also accepted the argument that Haru operated a genuine business model with real returns, and separating it from typical Ponzi schemes.

Two other executives i.e., Park and Song, co-CEOs of Haru’s parent company Blockcrafters, were also acquitted of fraud, while the firm’s COO, Kang, was convicted of embezzlement and sentenced to two years. Due to South Korean privacy laws, the first names of the executives were not released.

Though cleared of criminal wrongdoing, Lee and the others may still face civil liabilities to harmed investors. Lee has shared that he is cooperating to recover losses through the bankruptcy process.

Notably, these developments are unfolding against the backdrop of a growing South Korean crypto market, where daily trading on exchanges often surpasses activity on traditional stock markets. As user numbers pass 16 million, regulators are tightening legislative control. Recently, the Financial Intelligence Unit (FIU) cracked down on unregistered foreign exchanges and banned 17 of their apps on Google Play to curb illegal activity, according to Wu Blockchain.

These apps included KuCoin, MEXC, Phemex, XT, Biture, CoinW, CoinEX, ZoomEX, Poloniex, BTCC, DigiFinex, Pionex, Blofin, Apex Pro, CoinCatch, WEEX, BitMart. This action has been executed at the request of the Korean FIU, which indicates an effort from the agency’s end to protect investors from potential financial loss.

Also Read: Former SafeMoon CEO Braden Karony Convicted of Fraud and Money Laundering