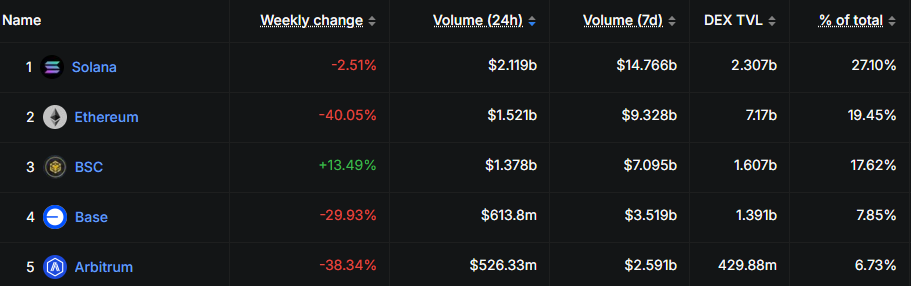

Solana has established itself as the dominant blockchain for decentralized exchange (DEX) activity and surpassed Ethereum and all other competitors in weekly trading volume. According to recent data, Solana-based DEXs processed $14.766 billion in trading volume over the past week.

The notable volume represented 27.10% of overall DEX volume and surpassed its nearest rival Ethereum, which took 19.45% of overall volume. The win comes as Solana’s slight 2.51% weekly drop in DEX volume.

Ethereum sees a drop in DEX volume

Ethereum, historically the epicenter of decentralized finance, saw its DEX volume decline by 40.05% over the same timeframe. The second-largest market capitalization blockchain registered $9.328 billion in weekly volume.

BSC was one of the few gainers and saw a 13.49% increase in DEX volume to $7.095 billion and to take 17.62% of the total market. Similarly, Sui posted a solid increase with a 14.76% increase, albeit with its $2.193 billion of weekly volume being a much lower proportion of the total DEX market at 4.17%.

Base and Arbitrum, both Ethereum layer-2 scaling solutions, recorded identical sharp weekly declines of 29.93% and 38.34% respectively. Base recorded $3.519 billion in weekly trading volume and Arbitrum recorded $2.59 billion.

Solana’s TVL in DeFi protocols is 2.307 billion, which is less than Ethereum’s at 7.17 billion. This difference between trading volume and TVL indicates that Solana’s DEXs are offering greater capital efficiency. This disparity between TVL and trading volume suggests Solana’s DEXs are achieving higher capital efficiency.

Solana could be at $180 by May

Solana has increased by 6.1% in seven days and by 28.1% in the last two weeks. It has also increased by 6.4% in 30 days.

Crypto analyst Ted compared the price move today on Solana to his observation in Q4 2022, the lower lows which formed the bottom and precipitated capitulation. According to this pattern, Ted expects a Solana bounce to $160-$180 come May. He also expects most likely a new ATH in Q3 2025.

Solana is leading the DEX volumes as it continues to attract developers and users with lower-fees and faster transactions.