In April’s third week, the cryptocurrency market showcased a low-volatility sideways action, evidenced by Bitcoin’s neutral candle formations. This consolidation reflects uncertainty in the market as China continues to retaliate against the United States’ barrage of tariffs. While the major signals risk of prolonged correction, the Solana price shows sustained rebound and recovery in a number of activity addresses. Is $200 close?

Solana Network Activity Spikes as Price Heads for Key Breakout

The daily chart analysis of Solana price shows bullish recovery from $95.28 to $132.2—a 38.8% increase — within two weeks. Consecutively, the asset market capitalization bounced to $68.5 billion.

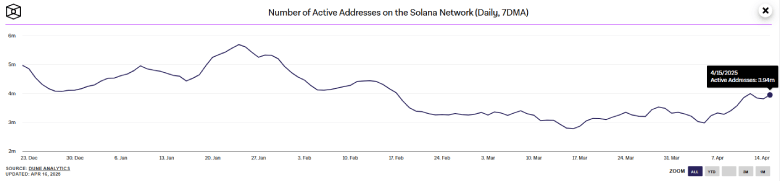

Simultaneously, the number of active addresses on the Solana network witnessed a sharp rebound from 2.97 million to 3.94 million, registering a 34% growth. This uptick indicates more users are transacting, deploying smart contracts, or interacting with dApps on Solana

Rising active addresses alongside a price rally add credibility to the ongoing bullish trend, suggesting that the recovery is backed by fundamental user interest, not just speculation.

If the trend continues, the SOL price recovery could gain higher momentum and drive toward a potential breakout.

SOL Price Eyes $200 Rally Amid EMA Breakout

Amid the recent market recovery, the Solana Pulse provided a bullish breakout from the fast-moving 20-EMA of the daily chart. Since late January 2025, the coin has shown several failed attempts to breach this dynamic resistance, as the previous reversal led to a significant downturn ranging from 28% to 27%.

The current market consolidation allows buyers to validate its sustainability above the 20-day EMA slope, which is currently coinciding with the $125 floor. If the buying pressure persists, the coin price could surpass the 50-day EMA slope, reinforcing its bullish momentum for a leap towards $180, followed by $200.

However, the anticipated recovery won’t be linear, as the overhead resistance would force occasional pullbacks in the SOL price.

Also Read: Ethereum Fees Plunge to 5-Year Low — What It Means for ETH Price