- Solana price maintains its midterm uptrend, resonating within the rising channel pattern.

- Amid the recent market pullback, the open interest tied to Solana futures plunged to $9.82 billion.

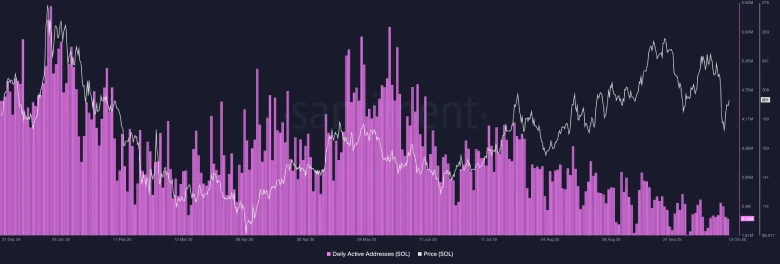

- Since January 2025, the daily active addresses on the network have recorded a steady decline and currently stand at 2.15 million.

SOL, the native cryptocurrency of the Solana network, recorded a 5.6% jump on Monday to reach the $208 mark. The buying pressure came as a relief after a massive sell-off on Friday, which recorded the largest liquidation in history. However, the on-chain data shows that network activity still lags, and the recent market pullback reset speculative traders, creating concern about whether the rally can be sustained.

SOL’s Market Rally Lacks On-Chain Backbone

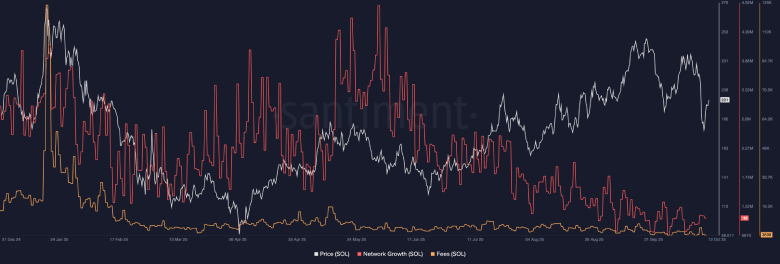

Before the recent market sell-off, the Solana price showcased a steady uptrend since April 2025. However, the metrics that tend to move in tandem with price—network growth and daily active addresses—instead cooled off steadily through the third quarter. The difference between valuation and underlying activity is widening as fewer wallets are appearing and fewer transactions are occurring.

That divergence was more pronounced following the October 10 market correction. On that day, Solana futures open interest fell significantly to approximately $9.82 billion. The downturn indicates a retrenchment not only on the network levels but also in speculative space. Crypto markets have seen an increase in volatility, with leveraged traders that may have contributed to the token’s previous rally now seeming to take a step back.

The result is a market going higher on lighter structural support. With trade activity being concentrated in a smaller circle of participants, the liquidity has been more circular than elongated. But given that the rally has not yet been accompanied by a corresponding increase in fees, active addresses, or new development activity, it suggests that the rally has so far been driven more by sentiment than by an influx of new users or developers.

For the short term, Solana’s trend now depends on which side of the equation—usage vs. speculation – manages to emerge victorious. A rebounding open interest would mean traders are willing to play again, and any rebound in on-chain activity would mean new adoption. Without a boost in one or both, the network’s upward movement may be supported but unsupported below the surface.

Solana Price Holds Uptrend Within Channel Pattern

In the last two days, the Solana price bounced from $173 to the current trading value of $208, registering a 21% surge. While this upswing followed the relief rally in the broader market, the SOL price showed a bullish reversal from the support of a rising channel pattern.

Since April 2025, the coin price has rallied in a steady uptrend, resonating within the two parallel trendlines of this pattern. The coin price rebounded at least twice from either boundary, indicating how strongly it influences the short-term trajectory.

The recent history of the pattern showcases that a reversal from the bottom trendline has often recuperated the exhausted bullish momentum and driven the Solana price recovery in the range of 65-97%.

With sustained buying, the SOL coin could extend its recovery and challenge the immediate resistance of $218, followed by $237. A bullish breakout from this resistance is crucial to accelerate the buying pressure and chase the pattern’s upper boundary around $270.

On the contrary, if this price reverts from the immediate resistance of $280.0, the sellers could force another retest of the bottom trend line.