SOL, the native cryptocurrency of the Solana blockchain, shows a 0.04% gain during Tuesday’s U.S. market hours. While the insignificant gain may indicate a lack of momentum, a deeper analysis of the daily candle shows a sharp price rejection from $150 to $151.5, indicating high demand pressure. This reversal can be attributed to strong support from below the level and renewed growth in the number of active addresses on the Solana network. Is a price rally to $160 close?

Solana Active Address Surge Suggests Ecosystem Expansion

So far in July 2025, the Solana coin has exhibited a sideways trend, confined within the $145 to $160 range. The daily chart displayed price rejection from both sides and an increasing number of short-bodied candles, signaling a lack of initiation from buyers and sellers.

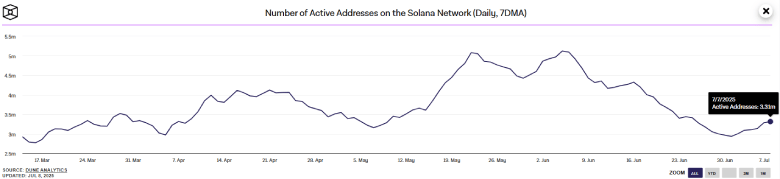

Despite the price uncertainty, the on-chain dynamics are telling a different story. According to TheBlock data, the number of active addresses on the Solana network has bounced from 2.93 million to 3.31 million, indicating a 13% surge in the last two weeks.

This surge in active users signals a renewed wave of engagement across Solana’s ecosystem, particularly in areas such as DeFi protocols, NFT platforms, and emerging Web3 applications. This rising trend could bolster the higher demand pressure for SOL and support price recovery.

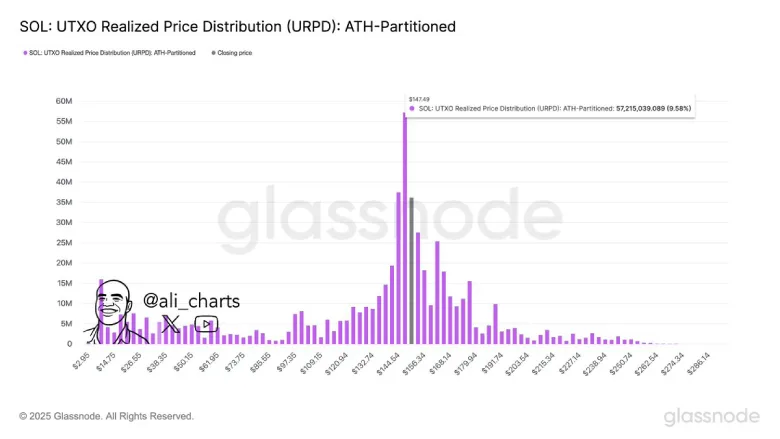

Adding to the bullish note, the SOL price is sitting atop a critical on-chain support level. According to Glassnode’s UTXO Realized Price Distribution (URPD) data, shared by market analyst Ali Martinez, the $147.59 level marks the highest concentration of realized SOL purchases of over 57.2 million coins.

The significant clustering of nearly 9.6% of the circulating supply creates crucial psychologically and technically significant support levels for the asset.

SOL Price to Exit Consolidation Trend with this breakout

The four-chart analysis of Solana price shows its current consolidation as the formation of a pennant pattern. Typically, the chart pattern displays a long ascending trendline, reflecting the dominating trends in the market, followed by short consolidations to replenish the exhausted bullish momentum.

Currently trading at $151.85, the SOL price is less than 1% away from challenging the resistance trendline of the chart pattern. A successful flip of the overhead resistance into a potential support will hint at the continuation of the prevailing uptrend.

The post-breakout rally could push the coin 5.5% higher to its $160 barrier, followed by an extended dip to $180.

On the contrary, a price breakdown from the pattern’s support trendline will intensify selling pressure.

Also Read: There’s Not a Lot Of Bitcoin Left: Fox Business Host