The escalating tariff tension continues to pressure the global market and cryptocurrencies in the second week of April. As a result, the Bitcoin price dives below $80,000 during Monday’s trading session, signaling the resumption of a market correction. Among the top assets, Solana price hints at a risk of major downturn as it loses a yearly support that acted as a major accumulation trend for buyers. Is SOL heading below $100?

Key Highlights:

- Solana price breakdown below $115 support should accelerate the bearish momentum for a 30% fall.

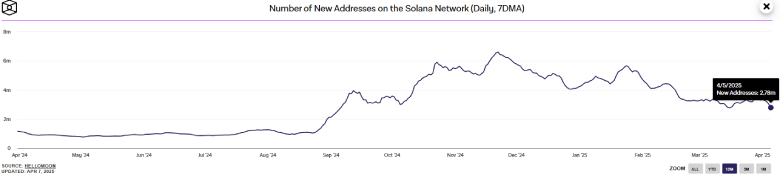

- SOL’s new wallet addresses dropped 58% to 2.78 million, showing a decline in retail participation.

- Theoretically, a fall below the 50% Fibonacci retracement level indicates weakness in buyers’ conviction to seek stable support.

SOL’s on-chain Metrics Reflect Waning User Confidence

Solana price analysis of the daily chart shows a major downfall from $295 to the current trading value of $107 — a 63% decrease — within three months. Consecutively, the asset market capitalization plunged to $54.2 billion.

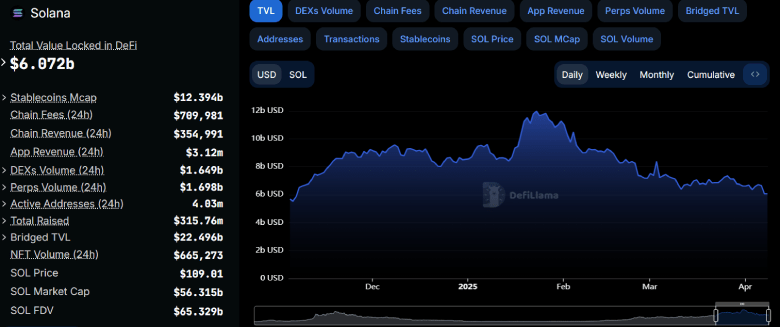

Similarly, the SOL’s total volume locked halved as it fell from $11.98 billion to $6.07 billion. This decrease in TVL underscores the reduced participation in DeFi protocols built on Solana, possibly triggered by capital rotation to other ecosystems or fear-driven withdrawals.

Additionally, the number of new addresses on SOL network plunged from 6.62 million to 2.78 million, registering a 58% drop. The downfall in new wallet creation further highlights weakening retail interest and a slowdown in user adoption.

If the trend persists, the Solana price will prolong the current correction and struggle to find suitable support.

Solana Price Breaks Below Yearly Support

On Sunday, April 6th, the Solana price gave a bearish breakdown from the yearly support of $112. The horizontal level coinciding with the 50% retracement level has created a major accumulation zone for crypto buyers.

Thus, the current breakdown should strengthen the seller’s grip over this asset and drive signaling the continuation of prevailing correction. If today’s price behavior shows sustainability below the $115 floor, the sellers may push a 30% fall to seek support at $80.

On the contrary, if the post-breakdown retest climbs back above the $115 floor, the previous fall would be marked as a bear trap to set a stronger rebound.

Also Read: $240M Vanishes from Crypto ETPs—Are Global Headwinds to Blame?