Apr 21, 2025 — The crypto market recorded a sudden inflow after Bitcoin recovered to $88,000. The buying pressure can be attributed to a declining trend in the U.S. dollar and investors’ swelling alternative investments compared to the currently volatile stock market. The renewed recovery bolstered several altcoins to counter the prevailing correction, as displayed by SOL’s sustainability above the key EMA at $135. Is Solana’s price ready to breach $150?

Strong DeFi Growth and Active Addresses Fuel Momentum

The daily chart analysis of Solana’s price shows a V-shaped recovery from $95.26 to the current trading value of $136.6, registering a 43% surge.

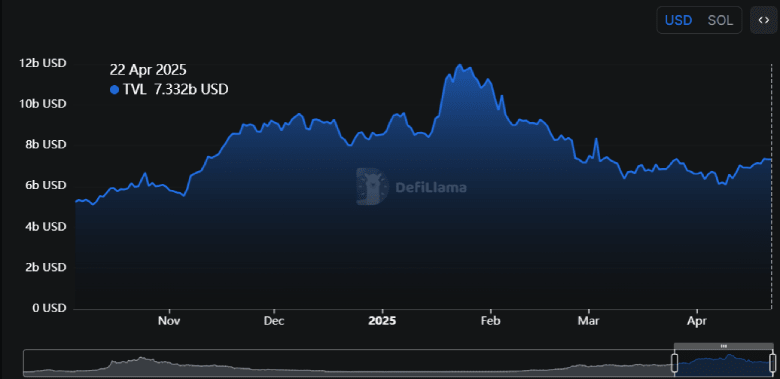

Amid the upswing, the total volume locked in the Solana network bounced from $6.09 billion to $7.3 billion— a 19.8% increase. This growth reflects a significant rise in the amount of capital being utilized within the Solana ecosystem, suggesting a surge in decentralized finance (DeFi) activity.

A higher TVL is often viewed as a strong indicator of a blockchain ecosystem’s health and scalability, which could drive demand pressure for its native cryptocurrency.

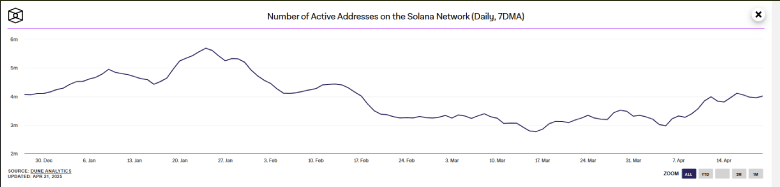

Adding to the bullish note, the number of active addresses on SOL bounced from 2.97 million to 4.01 million— a 35% surge — in the last three weeks.

This surge in active addresses highlights a substantial increase in user engagement on the Solana network, suggesting a growing interest in the ecosystem.

Solana Price Faces a 15% Potential Fall to $115

Generally, a reversal pattern shows aggressive buying pressure from market buyers but could lack stability if market conditions are unfavorable.

As the prevailing market trend is bearish, this low-volume recovery shows that the Solana price is susceptible to another downturn. Thus, the current upswing could witness renewed selling pressure, the combined resistance of $148 and the 100-day EMA slope.

The post-reversal fall, if plunged below the 20- and 50-day exponential moving average, will accelerate the selling pressure for a 15% drop to hit $115.

On the contrary, the combined growth of TVL and users’ active addresses should embolden buyers to defend the $115 support. A potential reversal from this floor would form a fresh higher low and project an initial signal for trend reversal.

Also Read: Bitcoin Price Hits $88,000 in Sudden Surge— Here’s What’s Driving It