Since last week, the crypto market has witnessed low volatility movement as China’s retaliation against imposed tariffs continues to affect the broader market. Defying the uncertainty, the Solana price showed notable resilience and bounced to $136 during Friday’s market. The upswing is likely fueled by the SOL network growth in the DeFi sector, but MEXC COO Tracy Jin warns that this recovery could be short-lived.

Solana Rallies on DeFi Growth but Macro Risks Still Loom

In the last two weeks, the Solana price bounced from a $95.26 low to a current trading value of $133, registering a growth of 40%. This bullish recovery is bolstered by a combination of favorable technical setups and fresh institutional support. Tracy Jin, COO of MEXC, highlighted that SOL’s resilience is influenced by recent developments, such as the launch of the first spot Solana ETFs in North America.

“The token’s reclaim of leadership in decentralized exchange activity and rising total value locked further support the bullish case,” Jin commented.

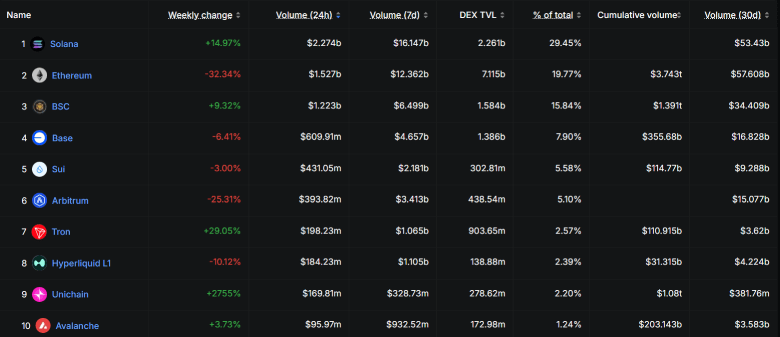

According to DeFiLlama data, Solana has surpassed its rival chains in decentralized exchange (DEX) volume, clocking an impressive $16.14 billion in the past seven days. Higher DEX volumes show that more traders and liquidity providers are actively using Solana’s ecosystem, increasing real demand for the network’s resources.

Despite recent gains, Solana’s near-term outlook remains sensitive to broader liquidity conditions. Jin warned that any deterioration in market confidence, driven by external macroeconomic shocks or renewed volatility in Bitcoin, could significantly cap the asset’s upside potential.

SOL Price Poised for Crucial Support Test Before Rebound

With an intraday loss of 0.7%, the Solana price shows its continued struggle to sustain above $133.6. The failed attempt to breach this resistance amid a volume spike and cascading liquidation underscores growing vulnerability.

If the bearish momentum persists, the SOL cryptocurrency could revert by over 14% to test the support at $115.26. A potential lower high formation at this floor is crucial for buyers to ignite fresh recovery, or the coin price could test another $100 breakdown.

The bearish alignment between the daily Exponential Moving Averages (50<100<200) accentuates that the path of least resistance is down.

Also Read: Trump May End Tariff War With China; Bitcoin $100K Soon?