SOL, the native cryptocurrency of the Solana network, bounced 7.5% during Friday’s U.S. market session to trade at $121.33. The buying pressure followed easing tariff tension among market participants as President Donald Trump showed willingness to form a trade deal with China.

As the broader market gains momentum, the SOL price teases a bullish breakout from the resistance of a three-month-long correction. Is this asset ready to breach the $150 barrier?

Solana Price Jumps as Tariff Tensions Ease

This week, the cryptocurrency market witnessed a bullish turnaround as Donald Trump paused reciprocal tariffs on 75+ countries. Thus, Solana’s price bounced from a $103 low to the $121 current trading value, registering a 19% gain.

Moreover, the microeconomic pressure is expected to ease further after the White House indicated that former President Trump is open to negotiating a trade deal with China—signaling a potential thaw in the prolonged tariff war

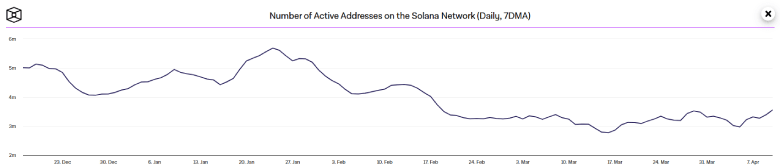

In parallel with the price jump across major digital assets, SOL also saw a notable on-chain recovery. According to TheBlock data, the number of active addresses on the Solana network bounced from 2.97 million to 3.55 million, projecting a nearly 20% surge.

This uptick in active addresses is a bullish indicator, as it suggests increased network engagement, higher transaction throughput, and rising investor confidence in Solana’s ecosystem.

If the trend persists, the coin price will gain higher stability and seek suitable support to bounce back.

Solana Price Poised to Escape 3-Month Correction

By the press time, the Solana price trades at $1.21 and holds a market cap of $1.62 billion. With today’s price jump, the coin price teases a bullish breakout from the multi-month resistance of a falling wedge pattern.

Since January 2025, this altcoin has been actively resonating between the two converging trendlines, validating the pattern’s strong influence on the price.

The daily candle closing above the breached trendline will accelerate the buying pressure and provide an early signal of a trend reversal. The post-breakout rally could drive the asset 46% up to challenge the resistance of $180.

On the contrary, if the breakout candle fails to sustain higher ground and revert within the wedge formation, the coin price could be prolonged till April end.

Also Read: Dogecoin Price Gains Momentum as 80M Tokens Move Into Whale Wallets