- The Solana price correction halts at $77.8 support amid the formation of a double bottom pattern.

- Rising on-chain participation signals renewed user engagement within the Solana ecosystem.

- The relative strength index indicator bounced from the oversold region indicates recuperating bullish momentum for recovery.

Solana, the seventh largest cryptocurrency by market cap, bounced 7.5% during the Friday’s U.S. market hours to trade at $84.99. The renewed buying pressure aligns with broader market sentiment as Bitcoin jumps above the $69,000 mark amid the release of January 2026 CPI data. However, the Solana price witnessed a stronger recovery as the number of active addresses on its network witnessed a steady growth and the technical chart shows a bullish reversal pattern.

SOL Network Resilience Builds Despite Weak Futures Sentiment

Since last month, the Solana price has witnessed a high momentum correction from $148.5 to $67.5 low, before making a short pullback to $85 value. Subsequently, the asset’s market cap tumbled to $48.29 billion.

Solana’s futures market has experienced a huge reduction in open interest, crashing from $8.8 billion to $5.1 billion per Coinglass data – a 42% decline. The main cause was wide liquidations of over-leveraged long positions due to the latest price correction throughout the entire crypto market.

Despite partial recovery in the price of SOL, the continued downward trend in the open interest suggests caution among traders. Such lack of speculative force could slow down recovery opportunities for Solana price highlighting denatured appetite for new leveraged positions in the derivatives segment.

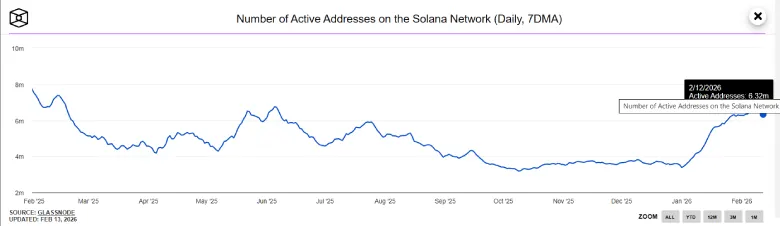

On the network level, however, engagement has rebounded quite strongly. Active addresses on Solana increased sharply from 3.44 million to 6.3 million, according to Block data. This indicates a renewed and robust user participation that continues even amid the turbulence of price and reduced speculations of trading in the futures.

While futures traders remain cautious with shrinking open interest and limited new leverage, Solana’s network shows clear signs of resilience through a strong rebound in active addresses.

Solana Price Eyes 20% Surge Amid Double Bottom

With today’s market surge, the Solana price showed a morning star candle pattern at $77.8 support. With sustained buying, the coin price would jump 5% and challenge the immediate resistance of $90.

An analysis of the daily chart shows this upswing as the second reversal from $77.8 within two weeks, indicating the formation of a double bottoms pattern.

The chart setup is commonly spotted at the major market bottom and accumulation zone to bolster price with renewed recovery. The momentum indicator RSI bounced to 33% accentuate a rising bullish momentum to support price reversal.

Thus, a bullish breakout from the pattern’s resistance trendline will intensify the buying pressure for sustainable recovery ahead. The post-breakout rally could push the Solana price another 14% to reach $102 mark.