The Solana price’s recent rally appears to be losing steam, with SOL’s value dipping amid a concerning trend for the network. Despite the buzz surrounding the Solana ETFs, the token price saw a notable dip as the daily transactions on the blockchain reached a severe low.

The cryptocurrency’s price surge has been a bright spot, but it’s now facing headwinds. As the industry holds its breath for a decision on spot Solana ETFs from major issuers like VanEck, Fidelity, Franklin Templeton, and Grayscale, the decline in network activity and token value raises questions about the potential trajectory of the Solana crypto price. It also sparks concerns about whether the altcoin could skyrocket after the ETF approval.

Solana Crypto Price Under Scrutiny

Solana’s price movements over the past month have been marked by high volatility, with a rollercoaster ride of ups and downs. Initially, the token traded in the green zone, reaching a monthly high of $251. However, by the end of September, it dipped to around $190, causing concern among investors. Yet, the bulls staged a comeback, pushing the price back up to a notable high of $236. While SOL continued to show fluctuations, it surged to around $229 earlier today following some major developments. But it has since pulled back to $219, only to show signs of reversal, edging back up to $226.

After a meteoric rise in late 2021, Solana has been struggling to break through key resistance levels. Despite powerful rallies, including a peak of $295 in January, the $250 zone has proven a tough hurdle to overcome. In the current run as well, the crypto failed to overcome this barricade.

At present, Solana crypto is trading at $226.10, up by 1.68%. Despite a 1.5% decline over the past week, the token has seen a monthly hike of 3.5%. The crypto’s struggle to overcome key resistance levels and make new highs has forced investors to take a cautious approach. Despite SOL’s current recovery, the community is showing less interest in Solana crypto, which is visible in the 9% decline in the 24-hour volume, which is now at $7.94 billion.

Transaction Volume Plummets 50%

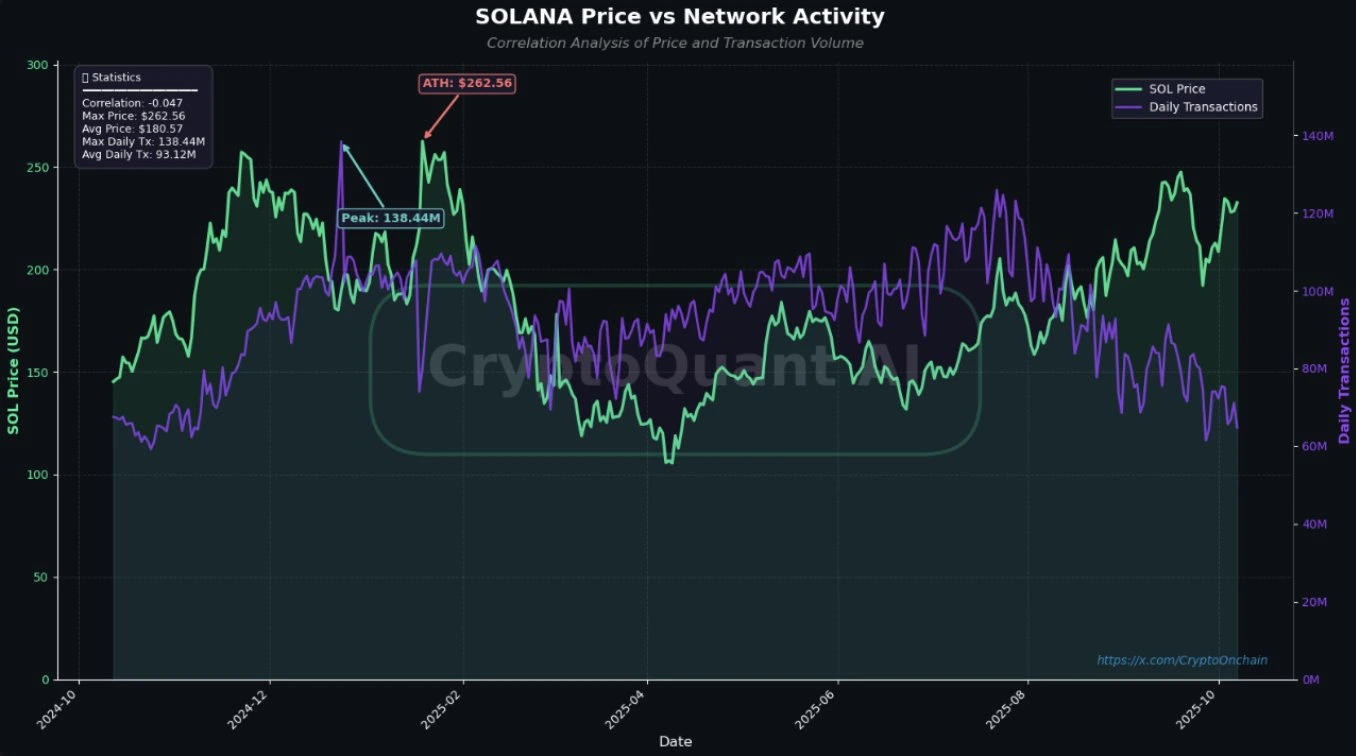

In an X post earlier today, CryptoQuant shared insights on the massive downfall in the daily transaction volume on the Solana blockchain. Despite the altcoin’s efforts to show a positive signal, the on-chain activity tells a different story.

Daily transactions have declined to nearly 50% since July 24, dropping from 125 million to around 64 million. The complete picture is nuanced, as around 80-90% of the blockchain’s transactions are voting transactions related to its consensus mechanism. The platform analysts wrote,

“This negative divergence between the price (an emotional and financial indicator) and the network’s fundamental activity (an indicator of real usage) serves as a serious warning. In a healthy market, price growth should be supported by an increase in the actual use of the ecosystem. However, the steep drop in transaction count strengthens the hypothesis that the recent price surge may be driven more by market sentiment and speculative activities rather than by a sustainable and organic increase in demand for the Solana network.”

Key Developments Today

Today’s Solana price surge is mainly driven by two key developments. This includes the expansion of Solana treasuries by two major platforms- Sharps Technology and DFDV. The Nasdaq-listed Sharps Technologies collaborated with Coinbase to expand its Solana digital asset treasury strategy. The company will utilize Coinbase Prime’s custody infrastructure and over-the-counter desk products to manage its Solana holdings.

On the same day, another major company, DeFi Development Corp. (DFDV) joined hands with Superteam Japan. This collaboration paves the way for the launch of the first Solana-based treasury in Japan.