Key Highlights

- SharpLink Gaming acquires 56,533 ETH at the average price of $4,462

- To fund this purchase, the company used $360.9 million fund raised through the ATM facility

- Tom Lee’s forecast suggests that Ethereum would likely bottom out within the next few hours.

On August 26, the leading Ethereum holding company, SharpLink Gaming, announced an acquisition of 56,533 Ethereum at an average price of approximately $4,462 for each ETH.

NEW: SharpLink acquired 56,533 ETH at ~$4,462. As of 8/26/2025 we hold 797,704 ETH valued at ~$3.7B

Key Highlights for the Week Ending August 24, 2025:

• $360.9M in net proceeds were raised through the ATM facility this past week.

• Total staking rewards rose to 1,799 ETH… pic.twitter.com/Kb4AKulf6f— SharpLink (SBET) (@SharpLinkGaming) August 26, 2025

SharpLink Accelerates Ethereum Acquisition

With this latest acquisition, SharpLink is now holding 797,704 ETH, with a total valuation of approximately $3.7 billion.

This large amount of accumulation, valued at approximately $3.7 billion, will solidify SharpLink Gaming’s position in the leaderboard of the biggest Ethereum holding companies.

This acquisition was funded by a recent capital raise initiative. Through its At-the-Market (ATM) facility, SharpLink generated $360.9 million in net proceeds during the week of August 18 through August 22.

The company reported that its average purchase price for Ether during this period stood at $4,462 per token. Beyond these acquisitions, the company maintains impressive liquidity, with approximately $200 million in cash still available to pursue future ETH purchases in the future.

Joseph Chalom, Co-Chief Executive Officer of SharpLink, stated in a press release, “Our regimented execution of SharpLink’s ETH treasury strategy continues to demonstrate the strength of our vision and the commitment of our team. With nearly 800,000 ETH now in reserve and strong liquidity available for further ETH acquisitions, our focus on building long-term value for our stockholders while simultaneously supporting the broader Ethereum ecosystem remains unwavering.”

The company is also taking advantage of staking yields, as the company actively generates rewards through staking. Since the inception of its treasury strategy on June 2, 2025, SharpLink has earned a total of 1,799 ETH in staking rewards.

A key metric highlighting the success of their approach is the ETH Concentration on a cash-converted basis, which has now surpassed 4.00. This figure shows an increase of over one hundred percent since the program’s launch just a month ago.

ETH Likely to See Bottom, Says Tom Lee

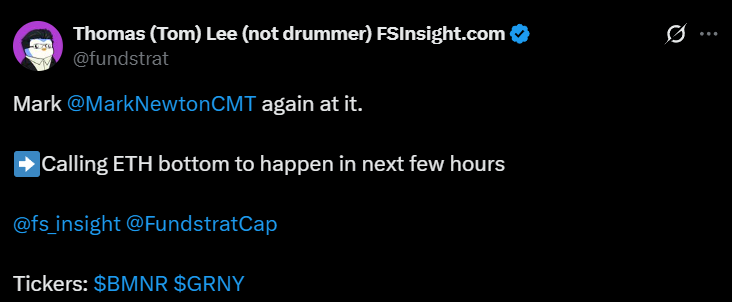

On August 26, Tom Lee, CIO of Fundstrat Capital and a prominent market analyst) shared an Ethereum prediction via his X (formerly Twitter) account for Ethereum. By citing insights from his colleague Mark Newton (a technical analyst at Fundstrat), he mentioned that Ethereum is likely to bottom out within the next few hours.

(Source: Tom Less on X)

Mark Newton said, “ETH is a very good risk/reward here. I am highly skeptical it breaks this trend or breaks 4067 from 8/18.. THAT’S what is required to think a bullish stance near-term is wrong.”

“Ideally this should bottom out sometime in next 12 hours near 4300 and start to push up back to new highs and get above 5100 and up to near 5400-5450.. that could be meaningful,” he added further.

His forecast comes amid a recent acquisition of a new Ethereum batch by BitMine. Tom Lee is the brains behind BitMine’s ETH staking strategy. Today, BitMine Immersion Technologies further expanded its massive ETH holdings by acquiring an additional 4,871 Ethereum, valued at approximately $21.1 million. This brings its total to 1,718,770 ETH, now worth around $7.65 billion and representing nearly 1.5% of Ethereum’s circulating supply.

“In the past week, BitMine increased its crypto and cash holdings by $2.2 billion to $8.8 billion (adding over 190,500 tokens from 1.52 million to 1.71 million tokens). This is the second week that BitMine has been able to raise capital from institutional investors at this pace, as we pursue the ‘alchemy of 5%’ of ETH,” Thomas “Tom” Lee of Fundstrat, Chairman of BitMine, stated in a press release. “At BitMine, we are leading our crypto treasury peers by both the velocity of raising crypto NAV per share and by the high trading liquidity of our stock.”

“We continue to believe Ethereum is one of the biggest macro trades over the next 10-15 years,” he added further. “Wall Street and AI moving onto the blockchain should lead to a greater transformation of today’s financial system. And the majority of this is taking place on Ethereum.”At the time of writing, ETH is trading at around $4,512 with a 2.61% drop in a day, according to CoinMarketCap.