Since last weekend, the crypto market has witnessed a bearish turnaround as Bitcoin plunged below $95,000. This selling pressure has stalled the prevailing recovery in most major altcoins, including LTC. The uncertainty surrounding the Litecoin price further accelerated as the U.S. Securities and Exchange Commission could potentially delay the approval of the CanaryFunds LTC ETF. Will this delay the $100 Breakout as well?

James Seyffart’s Outlook on Litecoin ETF Approval

In the last four days, the Litecoin price has plunged from $91.04 to $85.65, its current trading value, registering a 6% loss. Earlier today, the buyers attempted to recover this loss as the U.S. was expected to make its decision on the CanaryFunds Litecoin ETF filing.

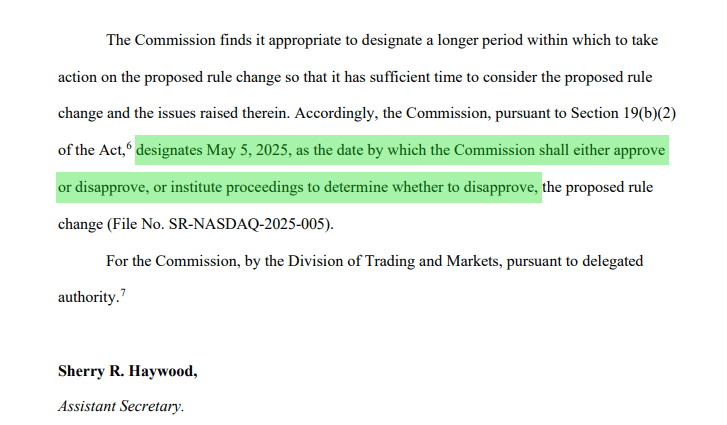

Earlier this year, the SEC delayed several filings, but the Litecoin ETF was not added to the list.

In a recent tweet, Bloomberg analyst James Seyffart stated that if any asset is likely to receive early approval, it would be Litecoin. However, he personally expects a delay in the decision.

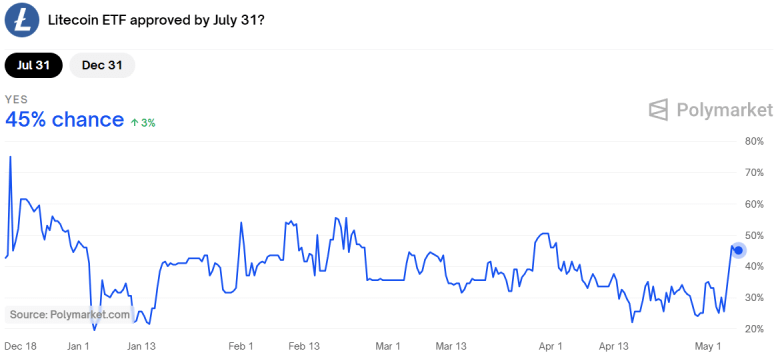

Moreover, the renowned prediction platform Polymarket has seen a notable increase from 26% to 47% for a potential Litecoin ETF approval by July 31.

Therefore, Litecoin stands as a frontrunner for ETF approval. If granted, it could lead to a substantial surge in institutional interest and trigger a price rally.

Litecoin Price Poised for Major Breakout

Since last month, the LTC price has showcased a sustained recovery from $63 to $86.32, projecting a 36% surge. The formation of higher highs and higher lows has pushed the asset above fast-moving exponential moving averages (20 and 50), signaling an initial change in market sentiment.

Amid the recent market downturn, if the coin price manages to sustain above $83 support, the buyers could surge 11.3% to challenge the $96.3 resistance. This level is a key pivot point for Litecoin, as it previously served as a major accumulation zone earlier this year.

The potential breakout will accelerate market buying pressure and push LTC for a $140 rally.

On the contrary, if the price breaks below the $83 floor, the sellers could drive a prolonged correction to $65.

Also Read: Donald Trump Says, “I Support Cryptocurrency, But Didn’t Profit From it”