Bitcoin remains on an upward trend because economic uncertainty is increasing, while renowned American entrepreneur Robert Kiyosaki predicts additional Bitcoin value rises from a deteriorating US economy. Robert Kiyosaki predicts that US bond sell-offs will break down the dollar market, prompting investors to choose hard assets, including Bitcoin. Meanwhile, the United States takes charge of world Bitcoin mining through official backing of mining facilities and government sanction.

Robert Kiyosaki Predicts Bitcoin Surge Amid Inflation

Based on his concern about US bond safety and rising inflation rates, financial expert Robert Kiyosaki predicts Bitcoin will attain between $180,000 and $200,000. He established that if foreign nations decrease their U.S. Treasury purchases, the economy and the dollar will collapse. Research shows that the US dollar index experienced an 11% decline throughout the last 100 market days of stress.

According to the author, trade policies and inflationary pressure created the economic change. Investors lose confidence in the Federal Reserve, moving toward Bitcoin and other decentralized and finite assets. The unstable currency environment made Kiyosaki identify Bitcoin, gold, and silver as secure protective assets.

Over the last fourteen days, Bitcoin has increased 29%, which indicates that institutional investors have become more attracted to its value. The market believes declining bond value would trigger movement across various asset classes. According to Kiyosaki, Bitcoin operates outside speculation because it stems from inadequate fiscal policies and laws.

US Bonds Decline Boosts Bitcoin Appeal

Kiyosaki renewed his price prediction on April 20th, 2025, when Bitcoin exchange rates stood at $84,000. During the first nine days, the market price surged from $84,000 to $94,000, demonstrating remarkable momentum. The market perceives these events as direct approval of the weakening currency and strengthening digital assets that Kiyosaki predicted.

Traditional market pressures emerged due to worldwide tensions and the weakening US dollar. US stock investors are moving their capital out of the healing Chinese economic market. Gold’s worth achieved its largest annual boost while sharing comparable upward trends with Bitcoin.

Unchanged US trade tariff policies might generate more adverse conditions in bond markets, accelerating dollar depreciation. Because of current market economic conditions, investors may flow their capital into Bitcoin and alternative hard assets. Bitcoin capital will accelerate its route toward reaching new all-time highs.

US Emerges as Global Leader in Bitcoin Mining

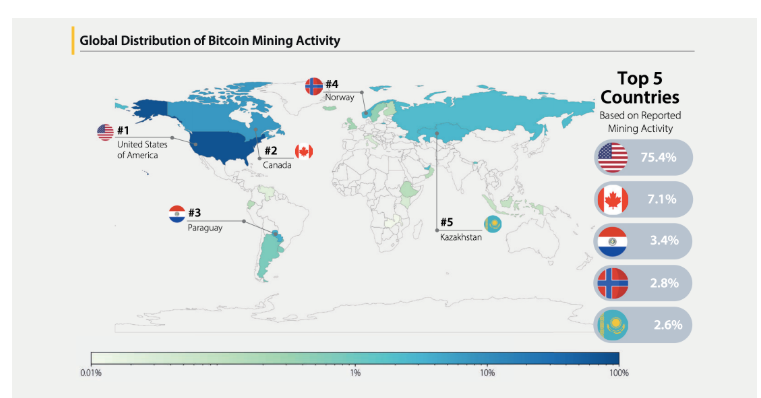

According to Cambridge findings, the United States holds 75.4% of total reported Bitcoin mining operation statistics. Even though mining operations might represent a 36% actual control, the United States maintains leadership because of government support and suitable operating environments. The global Bitcoin mining sector sees Canada, Paraguay, Norway, and Kazakhstan making smaller contributions after the United States.

The Cambridge Centre for Alternative Finance conducted research on Bitcoin mining activities between June and September 2024. A total of 49 businesses participated in the survey, which became the foundation for publishing the report after contacting 97 companies. Due to its predominant US sample, the survey potentially underestimates Bitcoin mining activity across other geographic regions.

The US Commerce Department supports mining operations through its Investment Accelerator initiative, which started under the March 31 executive order. Through this program, businesses gain access to investments exceeding a billion dollars, which enables them to construct their energy solutions near mining sites. According to official projections, the newly granted autonomy will trim expenses while decreasing pollution output and expanding national mining operations.