Ripple, the blockchain-based digital payment protocol, has officially applied for a national banking license with the U.S. Office of the Comptroller of the Currency (OCC).

(Source: Brad Garlinghouse on X)

The move places Ripple among a growing list of currency firms seeking to integrate with traditional financial systems while reinforcing regulatory compliance.

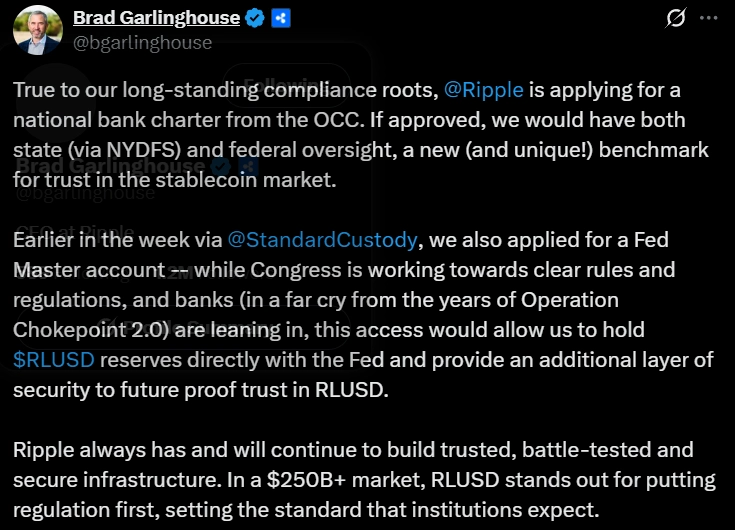

In a post on X (formerly Twitter), Ripple CEO Brad Garlinghouse confirmed the application, stating:

“True to our long-standing compliance roots, Ripple is applying for a national bank charter from the OCC. If approved, we would have both state (via NYDFS) and federal oversight, a new (and unique!) benchmark for trust in the stablecoin market.”

Garlinghouse also highlighted Ripple’s parallel application for a Federal Reserve Master Account through its subsidiary, Standard Custody, which would allow the company to hold reserves for its upcoming stablecoin, RLUSD, directly with the Fed. He emphasized:

“This access would allow us to hold RLUSD reserves directly with the Fed and provide an additional layer of security to future-proof trust in RLUSD. Ripple always has and will continue to build trusted, battle-tested, and secure infrastructure.”

What This Means for the Ripple Community

Ripple’s push for a banking charter shows a strategic shift toward deeper regulatory alignment, particularly as U.S. lawmakers work toward clearer crypto regulations.

By securing both state (New York Department of Financial Services) and federal oversight, Ripple aims to position RLUSD as a stablecoin that prioritizes institutional-grade compliance, a key differentiator in the $250 billion stablecoin market.

The application comes after a recent industry trend where crypto firms, including Paxos and Circle, have sought banking partnerships or licenses to enhance legitimacy.

For instance, one of the leading stablecoin issuers, Circle Internet Group, has applied for a national trust bank charter. With this advancement, the company is aiming to integrate stablecoins into the traditional financial world after the firm’s big market debut this month.

“Establishing a national digital currency trust bank of this kind marks a significant milestone in our goal to build an internet financial system that is transparent, efficient, and accessible,” Circle CEO Jeremy Allaire said. “By applying for a national trust charter, Circle is taking proactive steps to further strengthen our USDC infrastructure.”

If approved, Ripple’s federal charter could streamline its operations, reduce reliance on intermediary banks, and strengthen confidence in its financial products.

As Garlinghouse noted, this move marks a stark contrast to the adversarial stance regulators once held toward crypto (referencing Operation Chokepoint 2.0), with banks now increasingly embracing blockchain innovation.

Under U.S. President Donald Trump’s crypto-friendly administration, many crypto firms are seeking to become state or national banks in a bid to expand their businesses.

Alexandra Steinberg Barrage, a partner at law firm Troutman Pepper Locke, said, “We have seen a lot more interest. We are working on several applications now. Is it in full swing yet? I don’t think so. Our clients are being cautiously optimistic; they’re waiting for things to settle.”

Also Read: SEC Chair Urges Push for Tokenization in Stock Market