- Long-wick rejection candles at the bottom trendline of a channel pattern highlight that the Bitcoin price witnessed notable demand pressure at $110,000.

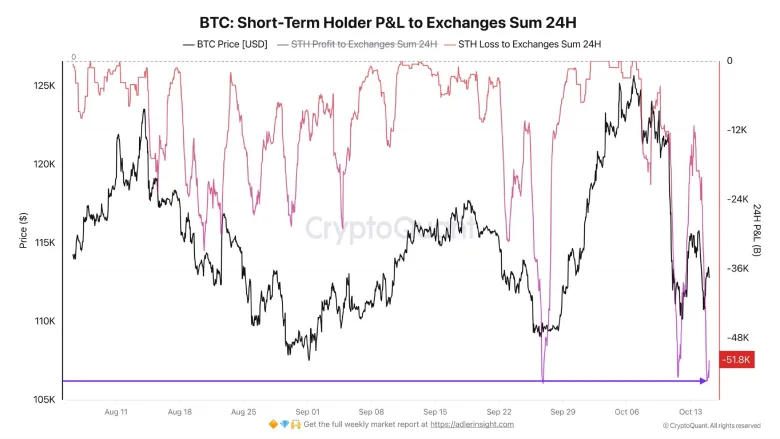

- Yesterday, over 56,000 BTC held by short-term traders at a loss were transferred to exchanges.

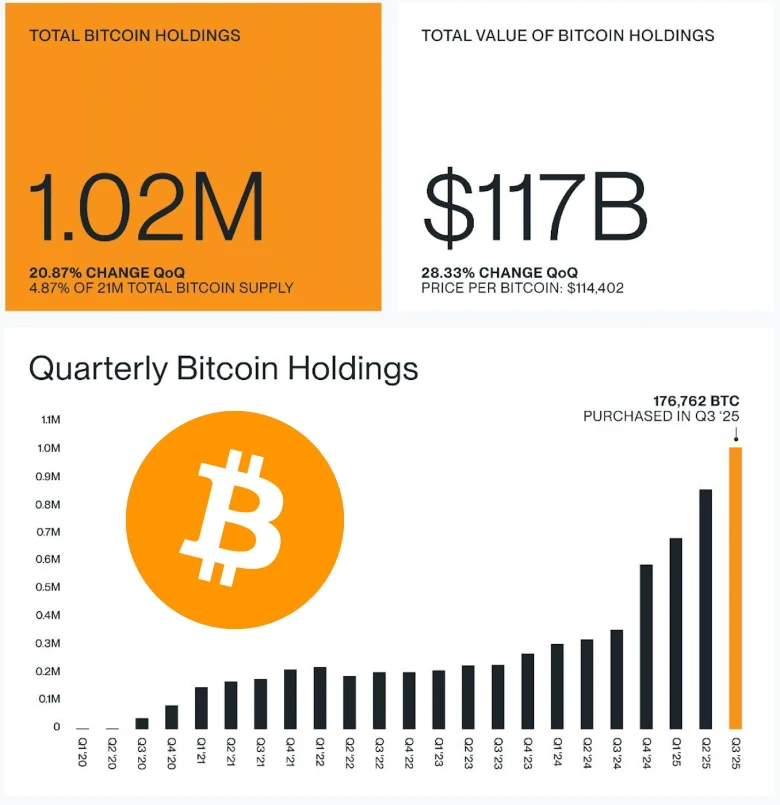

- Bitcoin’s corporate adoption accelerates in the third quarter, having purchased over 176,762 BTC.

The pioneer cryptocurrency, Bitcoin, took another dump of 2.14% during Wednesday’s U.S. market hours to currently teeter at the $110,000 floor. Following the short relief rally last weekend, the BTC price is challenging major support levels in its technical chart amid recuperated bearish momentum. The latest on-chain data further accentuates panic selling among short-term holders, projecting a potential volatility in the near future.

Retail Fear Meets Corporate Conviction in BTC’s Latest Shakeout

Last Friday, the crypto market got hit by the largest liquidation in history, causing a wave of panic among short-term Bitcoin traders. Despite prices settling around $112,500, on-chain activity portrays that the recent shock unsettled retail holders even more.

Yesterday, short-term holders (those who recently got into the market) registered another explosion of exchange inflows, with over 56,000 BTC being sent out at a loss. That single-day volume was even higher than the volumes experienced during the actual liquidation event, highlighting just how uncomfortable recent buyers have become.

This selling pressure has now occurred three times in less than a week, each time on modest declines in price rather than widespread market breakdowns. The repeated character of these moves indicates weak confidence among new entrants, many of whom are trying to exit holdings close to the cost of entry.

Historically, these retail-led exits have been more consistent with periods of deeper-pocketed investor demand absorption that have sometimes preceded the emergence of rebounds.

Amidst the turmoil, corporate players press on and increase their Bitcoin exposure at an ever-faster pace. As of the latest quarterly data, companies currently hold approximately 1.02 million BTC, which accounts for 4.87% of the total Bitcoin supply.

Corporate buyers alone amassed about 176,762 BTC in the third quarter of 2025, a single-quarter accumulation they’ve yet to achieve. Together, those positions total nearly $117 billion at current valuations, an increase in quantity by 20.87 percent and value by 28.33 percent from the previous quarter.

Although the accumulation trend goes back to 2020, the recent pace is unprecedented. Institutional and corporate balances have risen continually through each cycle despite wild swings of retail sentiment during short-term price volatility.

Bitcoin Price Teeters at Make-or-Break Floor

In the last two weeks, the Bitcoin price has witnessed a brief correction from $126,272 to the current trading price of $111,555, registering a 11.7% loss. The downward trajectory currently settles at the bottom trendline of a long-coming rising channel pattern in the daily chart.

Since late April 2025, the BTC price has strictly resonated within the two parallel trendlines of the pattern, which offers dynamic support and support to crypto traders. Despite the intraday loss of 1.11%, the daily candle shows a long-wick rejection candle at $110,000, indicating an intact demand pressure.

The recent history of the pattern has showcased that the lower boundary has often rebuilt the bullish momentum in price for a notable recovery ranging from 16% to 26%. If the buyers continue to defend this level, the BTC price could rebound and challenge the immediate resistance of $118,000 before aiming for a new high.

On the contrary, if the sellers force a bearish breakdown below the bottom trend line, the selling pressure would accelerate, and the Bitcoin price may enter a prolonged correction trend.

Also Read: Arbitrum Sees Largest Inflows: Will ARB Price Benefit?