- The symmetrical triangle patterns drive the midterm sideways trend in the Pepe coin price.

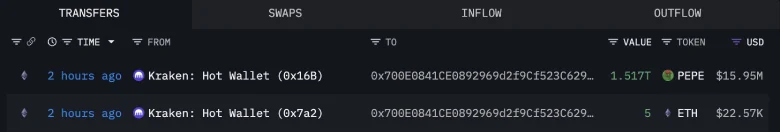

- The current price recovery is backed by renewed accumulation from large investors, as on-chain data highlights 1.52 trillion PEPE withdrawn from Kraken.

- Pepe futures open interest has recorded a 31% surge since last week, indicating heightened trading activity in the derivative market.

The frog-themed memecoin, Pepe, showcased a sharp jump of over 6.4% during Friday’s U.S. market hours to trade at $0.00001143. This buying pressure aligns with continued recovery in the broader crypto market as the Bitcoin price reclaimed $116,000. However, the Pepe coin price records higher momentum amid whale accumulation and heightened trading activity in the futures market. The rising price is now poised to challenge the multi-month resistance of an accumulation, signalling an opportunity for a major breakout.

Pepe Coin Rally Accompanied by Futures Boom and Whale Moves

Pepe coin has made a major comeback in the past couple of days, reversing the losses at the beginning of September. After hitting a low of near $0.00000937, the token has since surged to be around $0.00001135, which represents an upswing of nearly 21%. This recovery has sent the market capitalization back to $4.81 billion

The turnaround comes with a broader rally across digital assets after a brief correction in late August 2025. Derivative markets have tracked this transition, with futures open interest correlated to Pepe spiking. The CoinGlass data indicate that there is an increase from about $530.67 million to $695.8 million over the past week, indicating an increase of around 31%. The jump is pointing to heavier positioning and activity from traders interacting with the token’s futures contracts.

On-chain movements have also received attention during this time. Blockchain tracker Lookonchain pointed out that a newly created wallet withdrew around 1.52 trillion PEPE—worth nearly $15.95 million—from cryptocurrency exchange Kraken earlier today. The large transaction has quickly become one of the more notable whale-linked transactions on record this week.

The combination of recovering spot prices, rising derivatives exposure, and high-value token withdrawals highlights the magnitude of recent activity around Pepe coin, which makes it one of the more closely watched assets in the current cycle of the crypto market.

Also Read: Solana (SOL) Surges 3% as ETF Approval Nears in October

Pepe Coin Price Nearing Major Breakout From Triangle Pattern

The daily chart analysis of the Pepe coin price shows that the recent market recovery offered a decisive breakout from the formation of a falling wedge pattern. This chart setup is commonly spotted in a brief correction of an established uptrend. Following the breakout, the PEPE price managed to reclaim the 50-and-200-day exponential, reinforcing its position for a continued recovery.

If the daily candle closes above the 20-day EMA, the buyers could gain sufficient support to drive a 9.5% jump and challenge the resistance trendline of a symmetrical triangle pattern at $0.0000123.

Since January 2025, this meme coin has been resonating within the pattern’s two covering trendlines, driving a midterm sideways trend in price. Consolidating within the triangle, the PEPE price witnessed a major accumulation, building the bullish momentum for a major breakout.

The momentum indicator RSI (Relative Strength Index) at 61% and rising suggests the market sentiment supports the price potential for a higher rally. Thus, the buyers could breach the overhead trendline with the daily candle closing to confirm the end of the ongoing consolidation.

With sustained buying, the post-breakout rally could push the Pepe coin price 17.5% to hit $0.0000148, followed by a leap to $0.0000163 and $0.0000219.

On the contrary, if the sellers continue to defend the triangle resistance, the coin price could prolong the lateral trend for the coming few weeks or months.

Also Read: UK Trade Groups Push for Blockchain in UK–US Tech Bridge