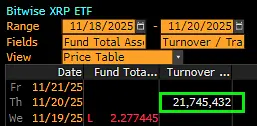

- NYSE officially began trading Bitwise’s new spot XRP ETF on November 20, recording an early trading volume of $22 million.

- On-chain data shows that crypto whales have transferred about 190 million XRP tokens to exchanges in the past 48 hours, signaling a risk of potential sell-off.

- The XRP price stands 2% short of challenging the bottom trendline of the multi-month channel pattern

XRP, the native cryptocurrency of the XRP Ledger, slipped 5.3% during Thursday’s U.S. market hours to trade at $1.99. The sell-off aligns with continued correction in the broader market as Bitcoin plunged to $86,000. While the XRP price faces additional pressure from the whale distribution, the traditional market investors showed notable interest in today’s launch of the XRP ETF from Bitwise, offering an added demand pressure for this asset.

Bitwise XRP ETF Sees $22M Early Volume Amid Whale Selling

On November 20, the New York Stock Exchange started listing a new exchange-traded fund by Bitwise Asset Management that holds actual XRP tokens. The ticker that is assigned to the product is XRP.

Trading volume stood at nearly $22 million in the first few hours of the session, according to data tracked by Bloomberg Intelligence analyst James Seyffart. This makes the Bitwise vehicle the second XRP-focused ETF to begin trading in the United States, following closely on the heels of the CanaryFunds XRPC product that continues to lead the way with year-to-date launch volumes among similar funds.

Bitwise said that it will charge a 0% management fee on the first $500 million of assets collected during the first 30 days of life.

Theoretically, the spot XRP ETF creates direct, sustained buying pressure by forcing the issuer to purchase real XRP for every new share, pulling coins off the market. Thus, the recently introduced XRP ETFs should bolster demand pressure for the cryptocurrency price.

That said, the on-chain data highlighted by Ali Martinez indicates that crypto whales have transferred about 190 million XRP tokens to exchanges over the past 48 hours. Historically, the large investors’ selling has coincided with major market tops and an accelerated downtrend in price. If the trend continues, the coin price could witness an extended correction below the $2 mark.

The spot price of XRP itself saw a notable intraday loss, aligning with the US trading session in which the ETF debuted.

XRP Price Just Inches Away From Major Support Test

The XRP price has recorded a sharp V-top reversal from $2.58 to $1.99—a 22% decrease—within a fortnight. This new lower-high formation signals an intact sell-the-bounce sentiment among market participants, accentuating the risk of a prolonged correction.

By the present time, the XRP price trades at $1.99, standing just 2.2% short of challenging the bottom trendline of a falling channel pattern. Since mid-July 2025, the XRP price has been resonating within two parallel trendlines as it provides traders with dynamic resistance and support.

The recent history of the pattern shows that a price retest to the bottom to support has often replenished the bullish momentum for a temporary upswing to the overhead trendline.

On the contrary, the steady increase in trading volume as XRP challenges the bottom trendline signals a risk of bearish breakdown. If it materializes, the market selling pressure would escalate and push the coin price to the next significant support of $1.6.

Also Read: Bitcoin Price Risks $90K Breakdown as U.S. Data Blackout Fuels Market Jitters