- Nasdaq Regulation formally certified the Canary XRP ETF for trading on 12 November 2025.

- XRP price is poised for a bullish reversal within the formation of falling channel patterns.

- Multiple XRP-based spot ETF applications are set to be effective later this month.

XRP, the native cryptocurrency of the XRP Ledger, showcased low volatility trading on Wednesday to hold its position around the $2.4 mark. The uncertainty emergency amid two counter sentiments among investors following the imminent launch of the first pure spot XRP ETF from the Canary fund and the continued correction in the broader market. Will the Ripple crypto hold its ground for a sustained recovery towards $3?

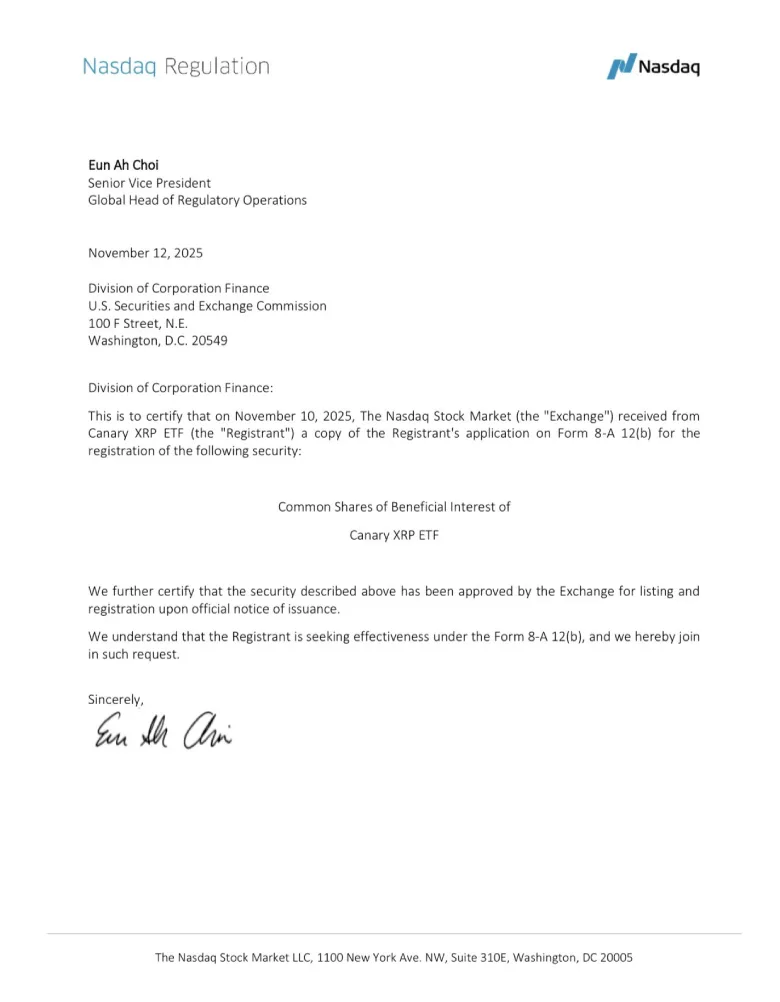

Canary’s Spot XRP ETF Gets Last Regulatory Nod

On 12 November 2025, the Nasdaq Regulation issued a formal certification to the United States Securities and Exchange Commission confirming the approval of the Canary XRP ETF shares for trading on the exchange. The shared document confirms that the exchange received the ETF’s Form 8-A12(b) registration filing on 10 November 2025. This step clears the way for the common shares of beneficial interest in the fund to begin operations.

The certification is happening amidst the ongoing changes in regulation, as the White House passed a bill to end the longest government shutdown in its history.

Canary XRP ETF, which is a single-asset vehicle slated to track the XRP cryptocurrency, is one of the first of its kind to clear a full listing. Trading under the ticker XRPC is planned to commence at the Nasdaq market open on 13 November 2025, following the effective declaration at 5:30 p.m. ET.

The prospectus of the fund provides details of holdings directly tied to XRP, excluding the wider basket exposures that are common with multi-token products. This is a configuration that makes XRPC a targeted investment option for investors who seek pure XRP price correlation, which has an annual management fee of 0.5%.

In a recent tweet, Eleanor Terrett shared a direct response from CanaryFunds Chief Executive Officer Steven McClurg commenting on the development: “We are very excited to go effective with the first single-token spot XRP ETF. This would not have been possible without the leadership of Chairman Atkins, Commissioner Pierce, and all the other fine people at the SEC who are pro-free markets!”

Additional XRP-focused ETFs are set to be effective later in the month. Filings from Bitwise, WisdomTree, Franklin Templeton CoinShares, Grayscale (Trust Conversion), and 21Shares are anticipated for potential launch after they appeared on the DTCC list.

XRP Price Eyes 9% Surge Before Hitting Key Resistance

Over the past week, the XRP price showed a notable reversal from $2.12 to its current trading value of $2.41, registering a 15% jump. This upswing likely followed the ETF developments surrounding this cryptocurrency, as Canary Fund takes the lead with a potential launch coming tomorrow.

A deeper analysis of the technical chart shows that this bullish reversal is positioned at the bottom trendline of the falling channel pattern. A recent history of the chart showcased that the support trendline is a reliable accumulation zone for buyers, with previous reversal gains of 22% before hitting major resistance.

Thus, with sustained buying, the XRP price could rise another 9% before challenging the key resistance level of the channel.

However, the current recovery swing could face renewed selling pressure at $2.53 psychological level as it coincides with the 50-and 200-day exponential moving average. If the sellers continue to defend this level, the XRP price consolidation could prolong into the second half of November.