- Qubic’s 51% control threatened Monero’s decentralization and trust.

- Miners distributed power and decreased Qubic share to safer levels.

- The deposits returned at Kraken, which caused a confidence boost and the growth of Monero recovery.

Monero (XMR) is back in the spotlight after recent turbulence, with the cryptocurrency recording a strong upward movement. On Monday, the XMR price surged by more than 5%, continuing a three-day winning streak that has outpaced the broader crypto market. The driving force in this revival is the recent hashrate issues surrounding Qubic, a mining cartel that was temporarily controlling a majority of the Monero chain.

Monero miners react after Qubic dominance

The issue unfolded when Qubic exceeded 51% of Monero’s total mining power, crossing the threshold that raised red flags across the community. Given that power, a pool can in theory interfere with transactions, filter blocks, or contort chunks of the blockchain. The proposed risk was a direct blow against Monero ideals of decentralization and privacy and it added doubt and swept in a ripple effect of selling pressure last week.

But the reaction of the wider mining community was quick and was organised. This disruption saw the independent miners shift their computing resources out of the Qubic pool and managed to reach as much as 35% share by August 17.

This defense mechanism contributed to redistribution of the balance in the network and gave confidence to the participants to be sure that network is resilient.Importantly, no evidence of double-spending or transaction tampering was found during the temporary majority control.

Kraken resumes XMR activity after miner action

In parallel, exchanges also reacted to the sudden concentration of hashrate. Kraken, one of the largest platforms trading Monero, initially froze deposits due to fears of network manipulation.The exchange has re-opened XMR deposits since then, but with more stringent security measures. New transaction will take 720 confirmations to be credited, which is intended to promote the stability of the network and network protection of users.

Rebounding confidence, both, viwa miners and exchanges have driven rebounds in demand of Monero. Its recovery proves the defense capabilities within the community as fast as well as the flexibility of the ecosystem to the issue of centralization.

Qubic has not taken explicit control of Monero consensus, but is still unknown what it would do next. Researchers caution that the collective can dispense with focus on other activities, such as recent claims that it intends to attack the Doge mining pool.

Monero has at least survived a critical test of its decentralization so far. The broad counteraction against the influence of Qubic can be used to underline the way the community can preserve the integrity of the network and enforce the ideals that still characterize the cryptocurrency.

Monero Price Rises 5% Amid Market Volatility Trends

At the time of writing, the XMR price is trading at $275.86 with a 5% surge over the past 24 hours. During this period, Monero recorded a high of $274 and a low of $260.

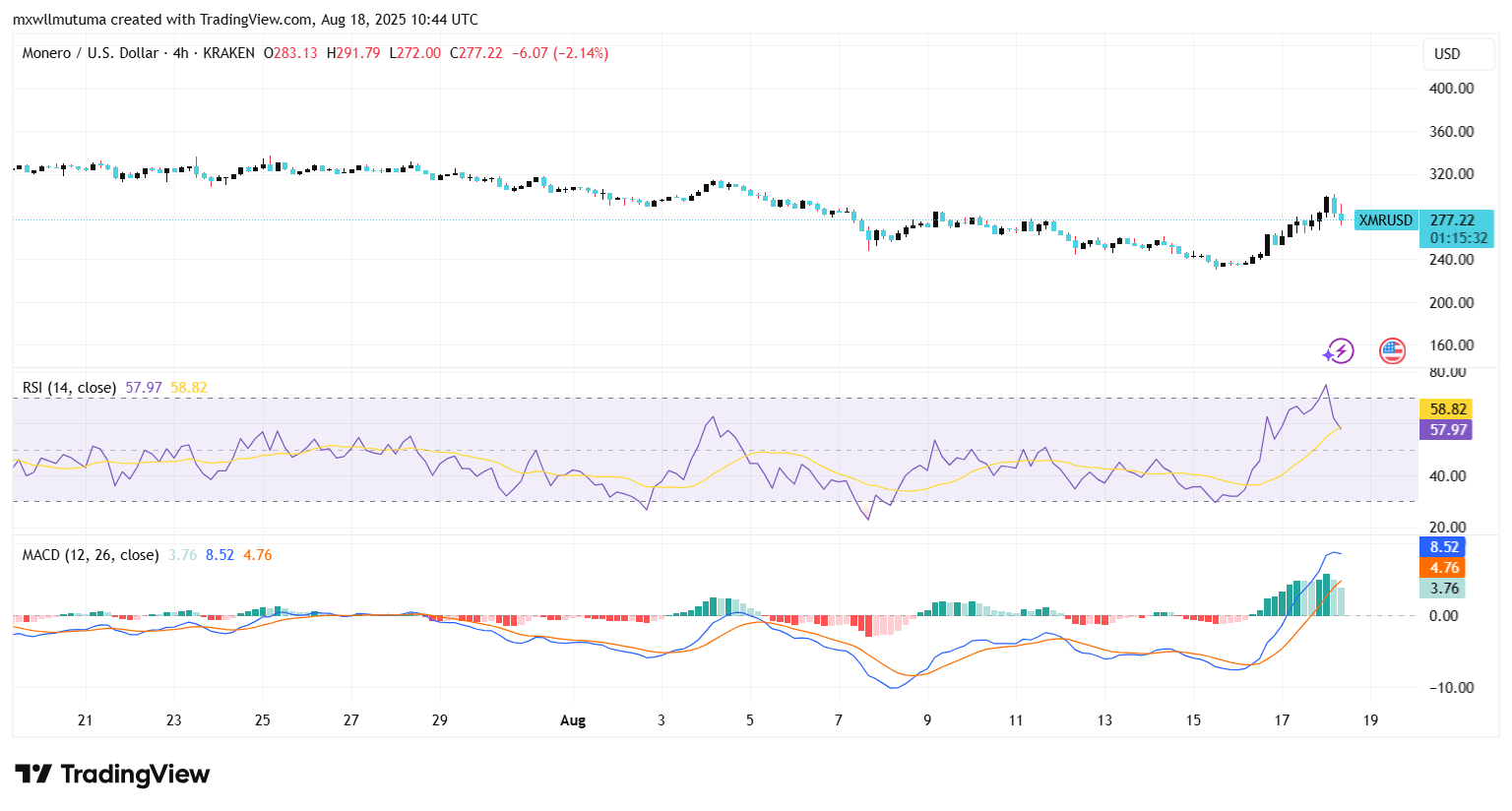

The Relative Strength Index (RSI) is 57.09, indicating neutral momentum following a temporary increase of higher momentum earlier this week. The indicator depicts that the current state of Monero is neither overbought nor oversold indicating that the traders are yet to submit to what may happen next with the price.

The Moving Average Convergence Divergence (MACD) is also indicative of a better sentiment. The MACD line stands at 8.41 and the signal line stands at 4.73 and the histogram is positive at 3.67. This convergence generally points towards strengthening bullish momentum, but the recent decline shows volatility has not ceased.