Japanese publicly listed company Metaplanet has announced via social media that it has plans to increase its Bitcoin Holdings.

Metaplanet Reveals New Plans for Bitcoin Treasury

*Metaplanet Issues 210 Million USD in 0% Ordinary Bonds to Purchase Additional $BTC* pic.twitter.com/cglQAFDKUi

— Metaplanet Inc. (@Metaplanet_JP) June 16, 2025

During its board meeting held on June 16, 2025, Metaplanet approved the issuance of $210 million in zero-interest ordinary bonds to the EVO Fund. The capital raised from this bond issuance will be used to acquire additional Bitcoin.

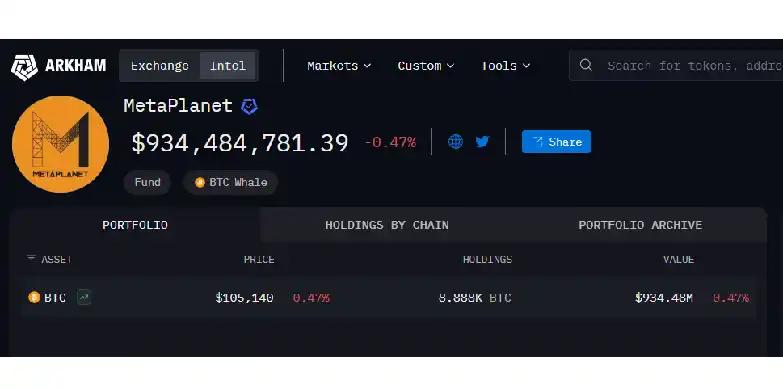

As of now, Metaplanet holds approximately 8,888 BTC, valued at $934.48 million.

This move follows Metaplanet’s recent surge in investor interest. The company’s stock (TSE: 3350T) spiked sharply after announcing plans last week to raise $5.4 billion for Bitcoin purchases. On June 9, the stock rose more than 12%, closing at 1,505 yen ($10.42), and peaked at 1,641 yen ($11.36) during the session, which is a gain of 22%. As of the latest trading session, the stock is trading at 1,707 JPY, which marks a 13.06% increase from previous levels.

In a June 6 filing, Metaplanet updated its Bitcoin acquisition strategy. It boosted its target from 21,000 BTC to 210,000 BTC by the end of 2027.

This aggressive push into Bitcoin aligns with a broader trend of institutional adoption. One of the earliest major movers was Strategy (formerly MicroStrategy), which famously converted a significant portion of its treasury into Bitcoin.

More recently, Mercurity Fintech Holding Inc. (Nasdaq: MFH) announced plans to raise $800 million as part of a long-term Bitcoin treasury reserve strategy. The fintech firm aims to integrate its holdings into a structured digital reserve framework, which includes institutional-grade custody, on-chain staking, and tokenized treasury management. The company says these blockchain-native mechanisms will enhance capital efficiency and build resilience into its balance sheet.

In a similar move, Thumzup Media Corporation recently filed to raise up to $200 million, with part of the proceeds earmarked for Bitcoin acquisitions.

These moves come as analysts forecast continued upside for Bitcoin. According to a recent market outlook from Coinbase, the first half of 2025 likely marked the bottom for digital assets. The report suggests that new all-time highs may be reached in the second half of the year, though it cautions about potential risks from rising bond yields and liquidation pressures from debt-laden crypto firms. Nonetheless, Bitcoin’s reputation as a store-of-value has regained a renewed institutional confidence.

Also Read: Bitcoin Risks Double Top Breakdown to $92,000 as Whales Start Selling