Mercurity Fintech Holding Inc. (Nasdaq: MFH) has revealed plans to raise $800 million as part of its long-term Bitcoin treasury reserve initiative.

Mercurity Plans a Bitcoin Treasury Reserve

The fintech company intends to integrate its Bitcoin holdings into a structured digital reserve framework. According to the official announcement, the framework includes institutional-grade custody solutions, on-chain staking, and tokenized treasury management. By adopting these blockchain-native strategies, Mercurity intends to improve capital efficiency while building resilience into its balance sheet.

“We believe Bitcoin will become an essential asset in the future of finance,” said Shi Qiu, CEO of Mercurity Fintech. “Our goal is to align the company with the emerging digital asset economy and establish ourselves as a forward-thinking player in blockchain finance.”

As part of its strategic shift, Mercurity will leverage its existing expertise in blockchain-driven infrastructure to manage the reserve. The plan involves systematically acquiring Bitcoin and deploying it through custodial and staking tools that generate yield and enhance liquidity. These efforts are expected to form the foundation of a sustainable, blockchain-aligned treasury.

In a related development, Mercurity is set to gain increased exposure in capital markets. According to FTSE Russell’s preliminary 2025 reconstitution list, the company is expected to move from the Russell Microcap Index to both the broader Russell 3000® and the Russell 2000® Indexes. This upgrade signals growing investor confidence and could attract institutional interest from passive and active funds.

“Being added to the Russell 2000 validates the work we’ve done in blockchain infrastructure,” Qiu added. “It shows that our growth strategy is resonating with the market, and this Bitcoin reserve initiative is a natural next step.”

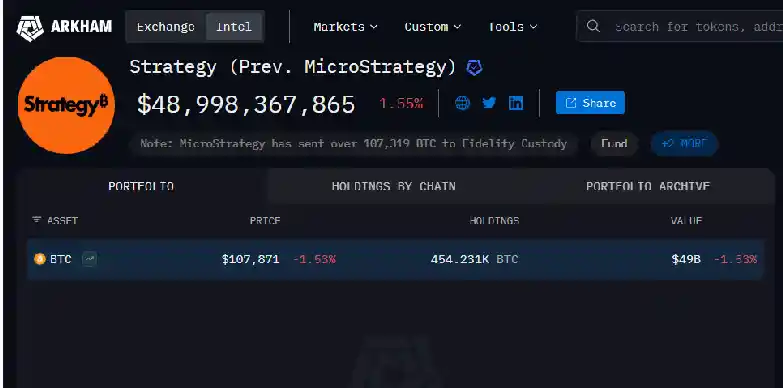

Mercurity’s move signifies an ongoing trend among publicly listed companies adopting Bitcoin as a strategic treasury asset. MicroStrategy, widely seen as a pioneer in this trend, has continued to expand its holdings. It currently holds 454.231K BTC which is worth $48,998,367,865 .

Moreover, Japan-based Metaplanet recently announced the acquisition of over 1,000 BTC worth approximately $117 million. Meanwhile, U.S.-based Thumzup Media Corporation has filed to raise up to $200 million in securities, partly to fund Bitcoin purchases.

Mercurity has already used proceeds from its October 2024 Nasdaq listing to begin acquiring Bitcoin.