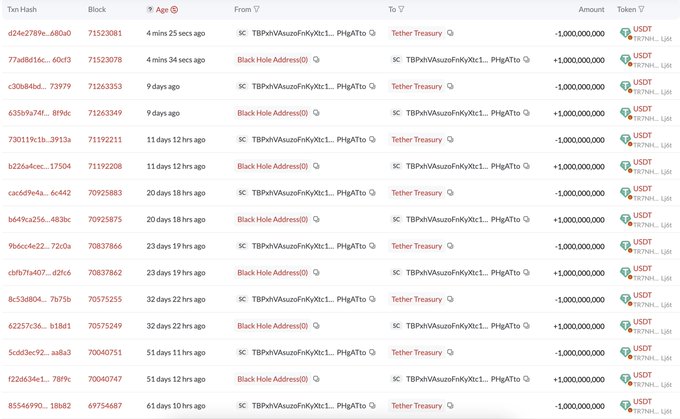

Tether has minted 1 billion USDT on the Tron blockchain, and Bitcoin quickly surged over 2.5% within hours. Following this mint, 500 million USDT moved from the Tether Treasury to the HTX exchange linked to Tron’s founder. Market activity suggests rising liquidity may be fueling renewed demand for leading cryptocurrencies.

Tether Issues 1 Billion USDT on Tron Blockchain

Tether launched 1 billion USDT on the Tron network shortly before Bitcoin rose steeply within 30 minutes. Blockchain records showed that the HTX exchange received 500 million USDT less than one hour after Tether created this amount. Justin Sun uses his influence to lead the operations at HTX through his role as Tron network founder.

Lookonchain analytics platform reported that Tether issued 10 billion USDT beginning January 29, 2025. The stablecoins were not associated with particular blockchains, even though ongoing activity persisted on the Tron network. The main stablecoin issuer, Tether, maintains its extensive reach among centralized trading platforms in crypto markets.

The new stablecoin release expands circulation levels, which might suggest to market participants that demand potential is increasing. Large-scale USDT minting operations have shown a historical pattern of strengthening cryptocurrency price trends. Speculation of intensified buying for cryptocurrencies increases because of the direct connection between Tether minting and exchange cash movement.

500 Million USDT Sent to HTX Exchange

Justin Sun’s exchange HTX received 500 million USDT directly from the Tether Treasury after Tron minted new coins. The funds exchanged quickly follow previous patterns observed during market construction phases. Exchanges usually perform these fund transfers before upcoming trading operations with expected high volumes.

Whale Alert and Lookonchain analysis demonstrated that the funds were part of Tether’s USDT growth initiative. The incoming stablecoin exchanges acquire trigger market-making operations and trading activities to modify asset values in these markets. The distribution occurs at a point when Bitcoin prices start to increase, thus supporting this assumption.

During this period, a large pool of traders works together instead of making random massive fund transfers. The entrance of USDT on cryptocurrency exchanges triggers users’ intended purchase behavior. Attention now turns toward potential market movements because half of the printed coins are within HTX.

Bitcoin Rebounds 5% After Sharp Drop

Bitcoin started its Monday trading session forcefully, gaining 2.6% within several hours to reach the $87,440 mark from its opening price of $85,212. The cryptocurrency market experienced an increase after Jerome Powell refused to reduce interest rates because of continuing price inflation. His announcement triggered a price decline, bringing Bitcoin to $83,290 that Wednesday.

The cryptocurrency has achieved a new high this month, demonstrating a 5% growth above its minimum value for the period. The market indicates growing confidence while new liquidity flows in, despite facing ongoing macroeconomic obstacles. The timing matches Tether’s significant minting of USDT and its delivery to HTX.

Donald Trump served as U.S. President when he criticized Federal Reserve Chair Jerome Powell’s interest rate policies while expressing his desire to replace him as Federal Reserve chairman. After political tension generated brief market chaos, the market has achieved a higher position. The recent recovery of Bitcoin and a growing supply of stablecoins leads market analysts to predict an extensive crypto market recovery.