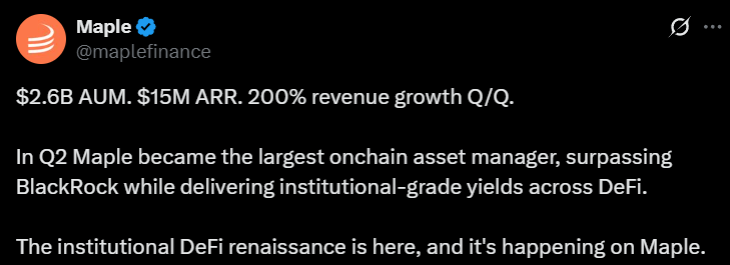

According to the latest data, Maple Finance has outperformed BlackRock’s tokenized BUIDL fund in total assets under management (AUM), which shows a great shift in the institutional adoption of decentralized finance (DeFi).

(Source: Maple Finance on X)

The on-chain credit platform now holds $2.6 billion in assets, surpassing BUIDL’s $2.3 billion, as demand for blockchain-based financial solutions continues to rise.

Maple Finance CEO Sidney Powell stated in a post on X that “Q2 saw major milestones for @maplefinance! Hit $2.6b AUM and reached a new high of $15m ARR. The mission to be the dominant onchain asset managet continues! Updated targets of $5b AUM and $30m ARR by the end of the year!”

Maple Finance is a decentralized lending platform that offers institutional-grade capital markets on the blockchain. It provides undercollateralized loans to crypto businesses, primarily through pooled liquidity from institutional and accredited investors. Maple operates on Ethereum and Solana.

The SYRUP token is Maple’s governance token, allowing holders to vote on protocol upgrades, fee structures, and risk parameters. While not a direct revenue-share token, SYRUP helps stakeholders in managing the platform’s growth.

Maple Finance’s SYRUP Token Soars 23% After Upbit Listing

While the crypto market is witnessing a downturn, Maple Finance’s governance token, SYRUP, surged around 11% in 24 hours after its listing on South Korea’s biggest cryptocurrency exchange, Upbit. Trading volume has also skyrocketed from $230 million to $892.7 million as demand for the token spiked.

According to some experts, this rally extends further with governance proposal MIP-018, which proposes boosting SYRUP buybacks by using protocol revenue. Its voting process will start from July 25.

Technically speaking, the token broke out decisively, hitting a new all-time high of $0.68 before settling near $0.59. The rally in the SYRUP token fuels strong trading volume and bullish momentum.

The rally in the SYRUP token comes amid the drop in Bitcoin and altcoins’ prices. As per the latest update, the biggest cryptocurrency, Bitcoin, has been pushed below $116,000 with a 3.23% drop in its price. Similarly, Ethereum has also maintained its correlation with BTC, plunging by 3.02%. At the time of writing, ETH is trading at around $3,639.62 with a market capitalization of $439.36 billion.

Also Read: XRP Holds Key Fibonacci Support Amid Growing Wallet Activity; $4 Close?