- Bitcoin price resonates in a symmetrical triangle pattern in the daily chart pattern.

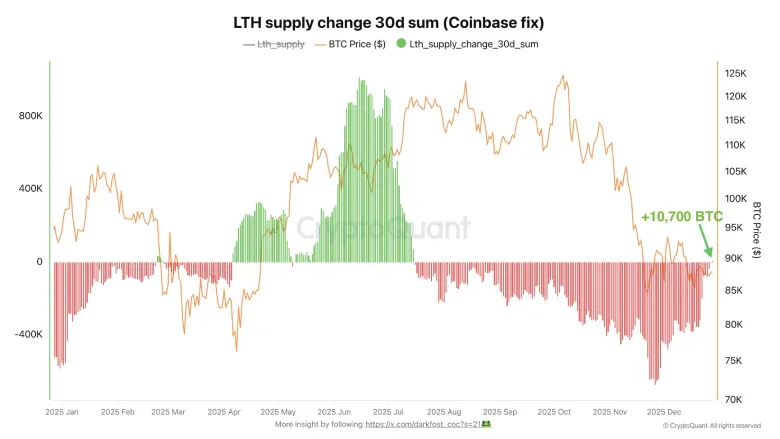

- Adjusted data shows a 30-day net increase of around 10,700 BTC among veteran investors

- A downsloping trend in BTC’s daily EMAs (20, 50, 100, and 200) highlights a strong bearish sentiment in the market.

The Bitcoin price jumps 1.38% during Tuesday’s U.S. market hours to trade at $88,322. The upswing came amid a macro sentiment shift as Fed’s December meeting minutes raised market’s expectations for further easing in monetary policy inflation declines further. However, the BTC price gained additional momentum as the prolonged distribution from long-term holders started recording a shift towards accumulation.

BTC Long-Term Holders Halt Distribution as 2025 Nears Close

In a recent tweet, market analyst Darkfost highlighted a subtle yet significant shift in the behavior of BTC’s long-term holders as 2025 is about to conclude.

Veteran participants – those who have held their coins for more than six months – are no longer contributing to the long-term shrinkage in their collective holdings. After taking into account a large, one-off transfer from Coinbase of about 800,000 BTC that distorted earlier numbers, it can be seen that the 30-day net change in supply among long-term holders has moved from consistent negative territory since mid-July to a small positive number of about 10,700 BTC.

This development shows selling activity by experienced investors has eased considerably. Meanwhile, more recent market participants (short-term holders with less than six month coins) show increased willingness to hold their positions rather than exit quickly on them.

The adjustment corrects broad-based narratives on the web about unprecedented distribution by experienced holders. Without the distortion of the major exchange movement, the underlying trend is to reduce outflow pressure and the gradual re-accumulation of supply among long term cohorts.

Such transitions have emerged in past market cycles before lengthy sideways trading periods or renewed upward price action but the results always depend on the current economic situation and general demand factors.

At present, the shift registers as being relatively small on a scale level, but it is a departure from months of steady contraction in the supply over the long-term segment.

This change indicates a shift in investors’ conviction as BTC price continued to consolidate around the $90,000 in late December 2025.

Bitcoin Price Await Key Breakout From Triangle Pattern

With an intraday gain of 1.46%, the Bitcoin price is heading for another breakout attempt from the $90,000 mark. Since late November 2025, the coin price has been struggling to sustain above this psychological level as the macroeconomics jitters continue to hamper bullish momentum in crypto assets.

Interestingly, the ongoing consolidation in Bitcoin price continues to resonate within two converging trendlines to reveal the formation of a symmetric triangle pattern. Theoretically, the pattern pushes the asset trajectory into a narrow range, which eventually springs the price for its next decisive breakout.

Currently, the Bitcoin price is just 1.3% short from challenging the pattern’s overhead trendline. A potential breakout from this resistance could bolster the buyer’s sustainability above the $90,000 resistance. The post-breakout value could potentially push the coin price another 12% and challenge the $100,000 barrier.

The 200-day exponential moving average wavering close to $100k mark, accentuates that the potential price behaviour at this level could drive the next trajectory.

On the contrary, if the sellers continued to defend the overhead trendline, the current consolidation in BTC could prolong in 2026.