- Litecoin price faces another bearish reversal within the falling wedge pattern, signaling a downside risk of 16.5%

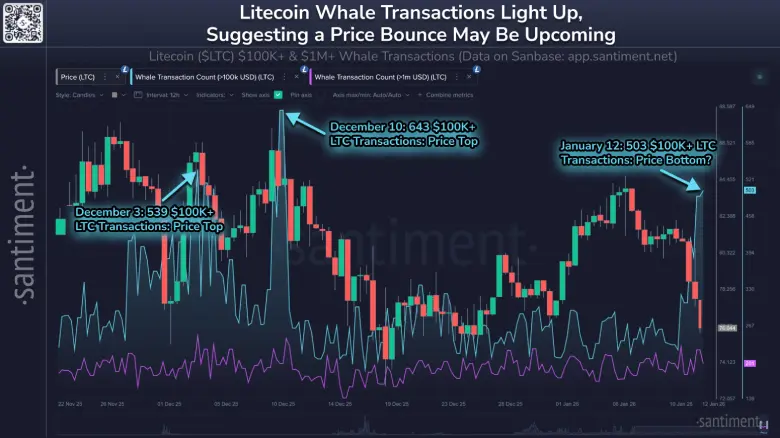

- Santiment data shows a sharp rise in large Litecoin transactions above $100,000.

- The momentum indicator RSI (Relative Strength index) at 45% highlights a neutral to bearish sentiment in market,

LTC, the native token of the Litecoin network witnessed a 0.86% surge during Wednesday market hours to trade at $78.77. The buying pressure this week triggered with the release of December 2025 U.S. data, easing fear of renewed inflationary pressure. In addition, the Litecoin price potential for higher rebound amid the increasing whale activity since last week. Will this altcoin return to triple digit value.

LTC Rebounds as CPI Data and Whale Moves Signal Shift

In the last 48 hours, the Litecoin price witnessed a renewed buying pressure, which recorded a surge from $75.2 to $78.7, registering a 5% gain. This uptick aligns with the recently released December 2025 US CPI data with headline inflation at 0.3% MoM and 2.7% YoY matching forecasts.

Bureau of Labor Statistics. These numbers coming close to market expectations are likely easing investors’ fear amid tariff tension and boosted for continued Federal Reserve rate cuts in 2026.

Recent figures from Santiment analytics platforms show a significant increase in the amount of large-scale Litecoin transfers, the highest in over a month. On December 3, 2025, there are transaction records of 539 transactions with a value greater than $100,000, which coincides with a peak in the coin’s market rate.

A similar pattern appeared on December 10 with 643 such high-value moves corresponding to another high point in pricing. More recently, on January 12th, 2026, the number of transfers over that threshold was 503, during a dip in valuation.

This increase in activity from major holders mimics trends seen in the past where increased transaction volume has often been an indicator of a shift in the direction of the market. The chart overlays these metrics with daily price fluctuations to show the way clusters of substantial trades have coincided with turning points. Separate lines keep track of even bigger deals over $1 million and there are parallel spikes here too.

Overall, the number of transactions on the network has been steadily increasing and reflects increased participation from major players in the ecosystem.

Also Read: XRP ETFs Record $8.72M Inflows as Total Assets Reach $1.49B

Litecoin Price Risk Another Bear Cycle With Wedge Pattern

In the past week, the Litecoin price witnessed a brief pullback from $84.9 to $77.6, registering a loss of 8.5%. Interestingly, the bearish reversal is positioned at the key resistance trendline of a falling wedge pattern.

Since October 2025, the coin price has resonated within two downsloping trendlines, driving a steady correction trend in daily charts. Historically, the reversal from the resistance trendline often accelerated the selling pressure in the market, leading to a fresh bear cycle within the pattern.

The Litecoin price is still holding below the daily exponential moving averages (20,50,100 and 200) indicate the broader market trend is bearish, indicating the path to lease resistance is down.

With sustained selling, the LTC price could plunge another 16% and hit the bottom trendline of the wedge.

However, with the increasing whale activity, the Litecoin price could witness a change in trend. If the price flips the overhead trendline into potential support, LTC could drive a renewed recovery to $101 mark.

Also Read: Solana Price Rallies as New Wallets Collapse — Warning Sign?