The decentralized peer-to-peer cryptocurrency Litecoin notably decoupled from the crypto market recovery last week. While the broader market celebrated Bitcoin’s new high of $112,000 after four months of consolidation, the LTC price continues to prolong its correction phase. Investor sentiment takes another hit as the U.S. SEC decides to delay the review process of the Litecoin ETF. Will a sluggish trend put LTC below $90, or are buyers waiting for a counterattack?

LTC Slides as SEC Delays CoinShares ETF Decision

In the last two weeks, the Litecoin price fell from $107.05 to $96.82 — a 9.6% loss— amid its ongoing recovery trend. While the downswing is likely a pullback to recuperate the exhausted bullish momentum, LTC’s underperformance amid the broader market recovery signals weakness in buyers’ conviction.

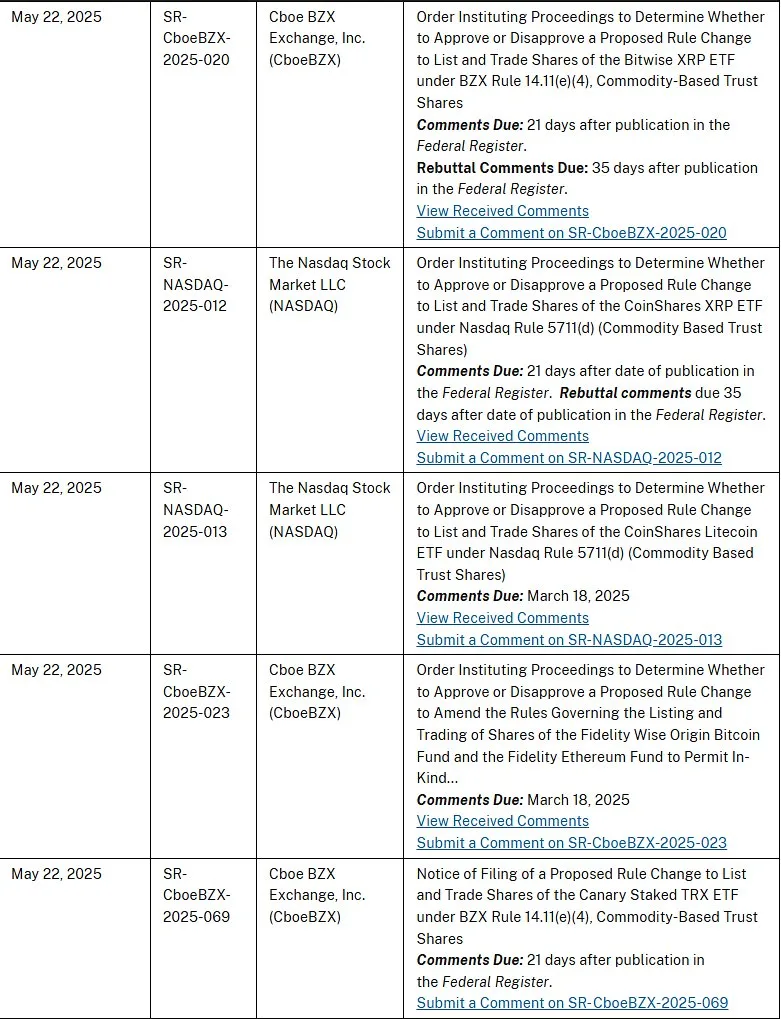

Investors’ confidence also took a hit as the U.S. SEC officially delayed its decision on the proposed CoinShares Litecoin ETF, listed under Nasdaq Rule 5711(d). The filing shared by James Seyffart highlighted similar delays for other cryptocurrencies, like Fidelity’s in-kind Bitcoin and Ethereum filing, BitwiseInvest and CoinShares XRP ETFs, and CanaryFunds’ staked TRX filing.

The continued indecision from the regulatory authority may weaken market sentiment and drive further price falls.

Litecoin Price 5% Away From Major Breakout

A deeper analysis of LTC’s four-hour chart shows the recent price dip resonated strictly within two falling trendlines, indicating the formation of a bull flag. This chart setup is common in an established uptrend, as buyers could replenish bullish momentum for the next leap.

The coin price trading above the daily exponential moving average (20, 50, 100, and 200) indicates the broader market sentiment is bullish on LTC.

If the pattern holds, the altcoin could rise 4.55% to challenge the flag resistance. A potential breakout will accelerate the buying pressure and signal the continuation of the previous rally. Theoretically, the post-breakout rally extends to the same length as the flagpole shot from the breakout rally.

If so, the LTC price is poised to rally 43% and hit the $145 resistance zone.

On the contrary, the current correction will continue until the sellers defend the overhead resistance.

Also Read: ETH Exchange Supply Crashes—Is $2,600 Just the Beginning?