- The Ethereum price seeks support at the June 2025 low of $2,100, evidenced by long-tail rejection candles in the daily chart.

- Coinglass data shows ETH futures open interest dropped from $41.9B to $26.3B.

- Since March 2020, a support trendline in daily chart charts act as a major accumulation point for investors.

Ethereum, the second largest cryptocurrency by market cap is down 2.9% during Wednesday U.S. market hours to trade at $2,166. While the broader market correction continued to put pressure on ETH, its price action revealed renewed buying pressure at $2,100, with long-tail rejection candles. However, a combined analysis with derivatives and on-chain data shows the correction could prolong to deeper levels before finding its bottom signal.

ETH Could Slide to $1,800 Before Finding a True Bottom

In the past three weeks, the Ethereum price witnessed a major drawdown from $3,400 to $2,165, accounting for 36%. Simultaneously, the assets market capitalization plummeted to $261.8 billion.

The downswing followed broader market correction amid geopolitical tension and macroeconomic uncertainty. Along with falling prices, Ether witnessed cascading liquidation in the derivative market. According to Coinglass data, the open interest tied to ETH futures contract witnessed a sharp drop from $41.9 to $26.3, registering a 37% loss.

A major drop in this metric can be attributed to force liquidation of long-positioned leverage traders. However, the continued decline or no signs of pullback indicate that the market participants are expiring their open contracts in the market to reduce exposure to ETH futures trading amid current market uncertainty. This move also removes the speculative force in the market that could bolster price for a bullish rebound.

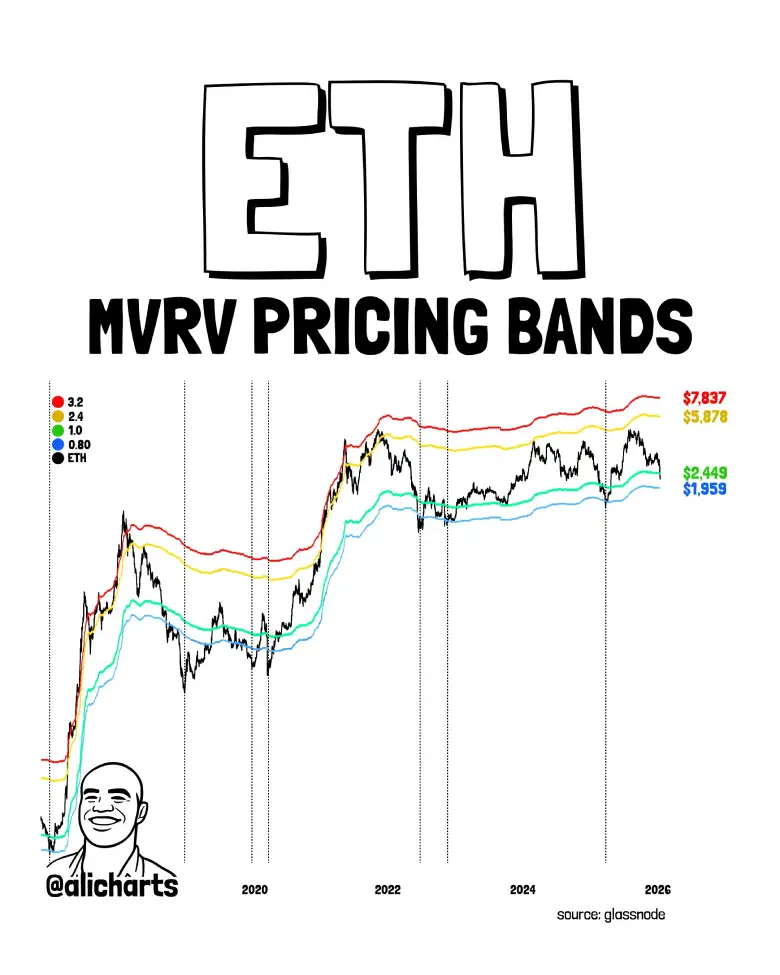

However, the market analyst Ali Martinez highlights an overlay of ETH’s price history from 2020 to 2026 with MVRV pricing bands.

The bands indicate multiples of realized value:

- Red (3.2) Marking upper extremes around $7,837

- Yellow (2.4) near $5,878

- Green (1.0) meaning fair value close to $2,449

- Blue (0.80) as the lower at about $1,959

In past examples, we can see ETH frequently making major cycle lows after dipping below or testing the 0.80 band, especially seen in the dotted lines of the 2022 downturns, before going on to recover and moving the price into higher bands. This sets the $1,959 zone as an important historical reference point based on the average cost basis of holders.

Ethereum Price Set to Retest Major Support at $1,900

By press time, the Ethereum price trades at $2,166, registering an intraday loss of 2.9%. The decline price currently seeks support from the low of June 2025 at $2,100.

The long-tail attached to the last three candles in ETH’s daily chart shows the buying pressure at $2,100. The demand pressure could trigger a temporary relief rally in price, resting overhead resistance at $2,340, followed by $2,610.

This upswing could recoup the exhausted bearish momentum in the market and drive a prolonged correction. The decline slope of daily exponential moving averages (20, 50,100, and 200) suggest the path to least resistance is down.

The post-pullback could push Ethereum price to a low of $1,800. This horizontal level coincides close with a long-coming support trendline at $1,900. This strong support could provide a bottom floor for buyers to build bullish momentum for the next leap.

Also Read: Binance Adds 1,315 BTC to SAFU Amid Bitcoin’s $76K Dip