DOGE, the largest meme cryptocurrency, records a 36% surge during Tuesday’s U.S. trading session. The surge in selling pressure continues to follow broader market panic amid the escalating trade war between the United States and other nations. The Dogecoin price now teeters at 5-month support, signaling the risk of another breakdown and prolonged correction ahead.

Key Highlights

- Dogecoin price breakdown from $0.143 support hints at a 30% fall ahead.

- The 20-day EMA slope will act as a first checker for traders if the Dogecoin downtrend is intact.

- DOGE futures open interest nosedives of 75.68%, reflecting reduced trader confidence and high liquidation pressure.

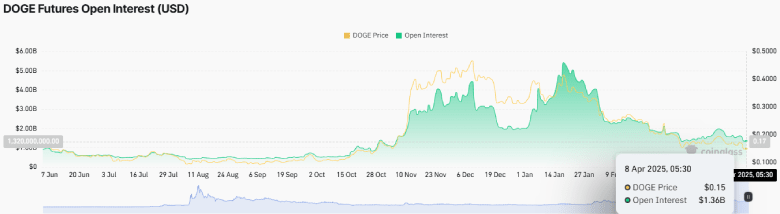

DOGE Futures Open Interest Plunges 75%—Speculative Interest Fades

By press time, the Dogecoin price trades at $0.143 and holds a market capitalization of $21.4 billion. Amid today’s downtick, the coin price teases a bearish breakdown from the five-month $0.143 that coincides with the 78.6% Fibonacci retracement level.

While the downfall to this FIB is still considered a buyer’s strength, it may offer a last line of defense. Therefore, a potential breakdown will accelerate selling pressure and change the market dynamic from a correction to a downtrend.

Following the price fall, the DOGE Futures Open Interest has plunged from $5.42 billion to $1.34 billion within three months, registering a 75.68% loss. This dramatic drop in open interest suggests a sharp decline in trader participation and speculative appetite around Dogecoin. It indicates widespread position closures—either due to liquidations or lack of confidence—signaling a weakening trend momentum.

Dogecoin Price Faces 30% Correction Amid Channel Pattern Formation

Over the past five months, the Dogecoin price correction has been resonating strictly within the two parallel trendlines of channel pattern formation. If the aforementioned breakdown of $0.143 supports offers a daily candle closing, the sellers could drive a nearly 33% fall to test the lower trendline of the channel pattern at the $0.098 floor.

The previous reversals from the bottom support have pushed the asset with a 42% to 65% rally, indicating a crucial accumulation zone for buyers.

As no trend remains the same in financial assets, the DOGE price could rebound higher with recuperated bullish momentum and challenge the resistance trendline.

Also read: Bitcoin Drops to 5-Month Low on Tariff Tensions, But Onchain Hints Rebound