- Bitcoin price correction teases a breakdown from the bottom trendline of an expanding channel pattern.

- JPMorgan analysts project Bitcoin could approach $170,000 within the next six to twelve months.

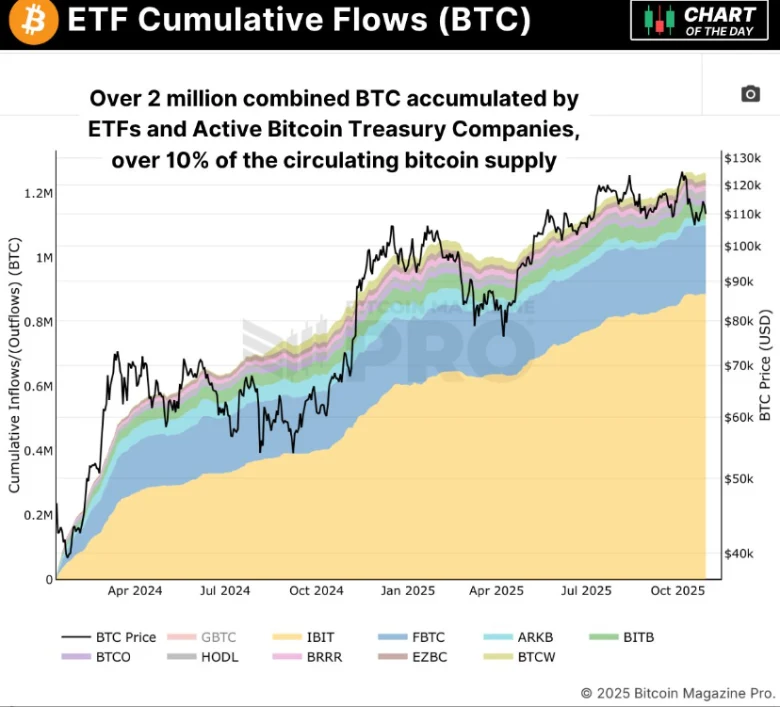

- Spot ETFs and active Bitcoin treasury companies now hold over 2 million BTC, accounting for 10% of the total supply.

The pioneer cryptocurrency, Bitcoin, is down 3.2% during Thursday’s U.S market hours, teasing a breakdown below $100,000 psychological level. Following a brief relief rally yesterday, the crypto market witnessed renewed bearish momentum today, signaling the continuation of the prevailing correction. Despite the mounting selling pressure, institutional conviction remains strong toward this asset, as JP Morgan analysts just dropped their prediction of BTC around $170,000 in the coming six to twelve months.

JPMorgan Sees BTC Hitting $170K Within a Year as Leverage Resets

JPMorgan analysts predict that Bitcoin could potentially reach almost $170,000 in the next six to 12 months, based on improving conditions from a major market deleveraging. The bank’s research team, led by the managing director Nikolaos Panigirtzoglou, noted that the level of leverage in perpetual futures markets has largely normalized after the record liquidations in October, the biggest in the history of the crypto sector, and smaller events in early November.

According to the report, the recent 20% drawdown from previous highs of Bitcoin has reset speculative positioning across the market, taking pressure from leveraged traders. The analysts highlighted that the spike in volatility coincided with the $120 million Balancer exploit in decentralized finance, which further impacted the investor sentiment.

JPMorgan’s projection is based in part on Bitcoin’s performance over the years, in comparison to gold. The bank noted that the volatility and valuation gap between Bitcoin and gold has shrunk, suggesting the digital asset could be trading at a lower value than its fair value. This relative undervaluation, together with leverage reduction and risk appetite stabilization, is viewed as a potential catalyst for price recovery in the coming months.

The report suggests that conditions responsible for the correction of Bitcoin have largely played out, creating an environment more favorable for medium-term growth.

Adding to the bullish backdrop, a recent tweet from Bitcoin Magazine Pro highlights that institutional players are tightening the noose on Bitcoin’s supply even further. More than 2 million BTC is now collectively held by spot Bitcoin ETFs and corporate treasuries—accounting for more than 10% of the total circulating supply.

This continued accumulation indicates serious institutional demand, with large hands taking steady amounts of the available supply even as the market correction continues.

Bitcoin Price Teases Major Breakdown Below $100k

This week, the BTC price witnessed a notable pullback from $110,732 to a current trading value of $101,205, accounting for an 8.6% loss. The falling price currently seeks support at the bottom trendline of an expanding channel pattern, coinciding with the $100K support.

Yesterday, the crypto buyers attempted to rebound from the bottom trendline with a green day of 2% gain. However, the buying force failed to follow up, and thus the coin price now challenges the psychological level and the channel support.

If the Bitcoin price gave a strong breakdown with daily candles closing below the $100k mark, the selling pressure would accelerate to drive a prolonged correction towards $93,270.

On the contrary, the last two days in Bitcoin showed long-tail projections at the pattern’s bottom trendline, indicating intact demand pressure. If the price action concludes in a similar manner today, the Bitcoin price will continue to build momentum for the next rebound.

Also Read: Hadron by Tether, KraneShares & Bitfinex Partner Up to Boost Tokenized ETFs